By Barbara Knoblach, PhD, CFP®

With every changing season or life stage, we tend to reflect and look towards the future. We hold memories close and feel excited about what is to come.

Such reflection is an opportunity to pause and remember why you work hard and to recommit to your life goals – including the important retirement goals. Who doesn’t dream of the day when all four seasons are theirs to shape and enjoy?

Retirement looks very different to everyone, and one of the most important things to consider when planning yours is the optimal time to apply for Canada Pension Plan (CPP) benefits. As well as some of our latest recommendations:

- Strategies for How to Budget for the New Normal

- The Financial Realities of Retirement during the COVID-19 Pandemic

- Is Financial Freedom Still Possible?

All it takes is a bit of calculated foresight to make the decision that will best suit your circumstances.

Here’s a look at some basics:

Canada Pension Plan benefits can be drawn as early as age 60 (reduced 0.6% for each month before 65) or as late as age 70 (increased 0.7% for each month after 65).

The average life expectancy for Canadians is age 80 for men and 84 for women. Statistics Canada predicts a continued rise in life expectancy of roughly two years over the next 15 years.

Things to consider:

Life expectancy

Contemplating your mortality may feel uncomfortable, but it should not be ignored. Your health and whether longevity is a family trait, are things to consider when making your decision regarding CPP.

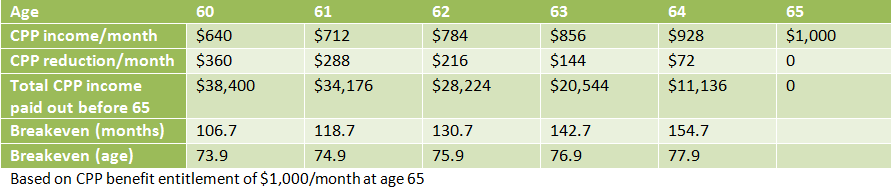

If you take your CPP starting at age 60, your breakeven point with someone who waits until age 65 is when you both turn 74. Confused? Let me put it another way – I will use an example to illustrate my point.

If Mary takes her CPP at 60 and Brenda takes hers at 65, Mary’s monthly CPP payment will be 36% lower than Brenda’s, but she will collect five years longer. They will be 74 when Brenda pulls ahead of Mary for overall amount collected.

CPP Breakeven Point Chart

Working and collecting CPP

Working and collecting CPP

If you believe good genes are on your side and there is a strong chance you’ll be collecting CPP into your 80s, it may be beneficial to wait until age 70, but only if you can afford to do so. How much cash flow you have from other sources is as important a consideration as your health. If you are living on a restricted income, it may be better to take CPP sooner and enjoy an improved quality of life while you are best able to appreciate it.

Even if you don’t retire at age 60, you are eligible to collect CPP. But you and your employer will still be required to make CPP contributions until age 65. If you are still working between ages 65 and 70, you are no longer required to contribute if you are collecting CPP, though you may choose to, thereby increasing your CPP benefits.

CPP benefit entitlements

It’s also important to understand how much CPP benefit you are entitled to before you decide the optimum time to collect.

As of 2020 the maximum benefit is $1,175.83 per month, but you might not qualify for the maximum. It all depends on how much you contributed over the course of your working life. According to the Government of Canada website, the average amount new beneficiaries received at age 65 was $672.87 in 2019. If you would like to know how much you can expect to receive, you can request a Statement of Contributions through your Service Canada account.

CPP is part of a bigger plan

Ultimately the decision on when to apply for CPP should be part of a broader retirement plan. It’s important to develop as clear a snapshot of your retirement income and expenses as possible. Do you plan to travel or are you likely to be more of a homebody? Will you be joining a golf club, or buying season tickets for your city’s sports team or theatre company? Do you foresee downsizing your home? If not, will you be mortgage free? What about vehicles? Will you and your partner downsize to one vehicle? Are there health concerns that may need accommodating? Will you want assistance, such as cleaning services and lawn care, to help maintain your home? The questions you need to consider are as varied and numerous as are retirement lifestyles.

Once you have a clearer picture of your possible expenses, you can stack those against your projected income sources. Aside from investment portfolio (RSPs, pensions, non-registered investments, stocks, and TFSAs), OAS, and CPP, perhaps you intend to work part-time as a consultant in your past profession, or step out into something completely new.

It’s essential to determine if there is a gap between the money you will need and the money you will have.

The sooner you discover that gap, the sooner you can start finding ways to close it. If that sounds overwhelming, there is no need to do this on your own. A money coach can help you create a retirement plan that supports the future you desire. Contact one of our Money Coaches and get started today.

This post first appeared in 2016. It has been updated with current data and republished.

NOTE: The author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

The statement of contributions from Service Canada is an OK approximation of what you will get when you actually reach age 65. It doesn’t include drop-out periods for the primary caregiver of children when they were under age 7 which would potentially boost your entitlement. It doesn’t account for retiring early which would cause a drop in your entitlement.

I’m a bit confused about how working on a contract basis after retiring early from regular FT job affects CPP. If earning income without continuing to pay into CPP, will that reduce CPP payments once claimed?

Hi Kathy, the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

Helpful post Barbara, thanks!

Wondering if you find clients ask for a breakeven analysis that factors in a rate of return on the money received early if they don’t spend it all and put all or a portion in a TFSA for instance?

Hi Chris,

interesting question, no I never had a client who wanted to put their CPP pension into investments. Discussions tend to revolve around the question of whether clients needs to take CPP early to meet their living expenses. There are certainly folks out there who do not need to spend it all. The question then becomes of whether they will have enough willpower to resist spending all the money or whether they will be better off postponing their CPP benefits.

Good point about willpower Barbara. Another consideration might be the client who’s primary objective is leaving as much to their beneficiaries as possible and since they don’t know their date of departure may start drawing their CPP sooner than later. Does this scenario make sense?

I’m one of those few who drew their CPP early (60) and was still working F/T until 62Yrs 3Mths. I used the CPP to reduce debt (no new spending) after total debt was paid off in Feb this year. I began placing CPP in TFSA for travel fund in our Go-Go years! My wife is still working F/T until Feb next year. My question: Are lost opportunity costs factored into the break even age of 74? Aside from those who need to draw on CPP early for retirement income, I’ve always asked why anybody would leave “money on the table” if their intent was to pay down debt (save on interest costs)or place in savings (no tax payable on balance during go-go years) Thankyou!

Hi Brian, the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

I agree with Barbara. When someone decides to elect CPP early for investing purposes, I would double-check their cash flow to ensure the money stays invested as it’s very easy to decide to draw from a TFSA.

Assuming you have the discipline to invest, you can accumulate savings from the early CPP for 5 years and then turn that amount into income that compensates for the extra CPP income you would have received if you waited until age 65.

My modelling suggests a 3% return on the TFSA would be enough to match the age 74 break even. A compounded annual 6% return on the TFSA stretches the break even to age 80.

Your longevity still has the biggest impact. Contact a Money Coach to determine the best CPP election start date in the context of your entire financial picture.

What if a person still works 60 hours per week, take early CPP at age 60 and put that amount into RSP investment to offset tax implication of increasing income with CPP

Hi Helene,

Taking CPP early and then contributing it to an RRSP would result in no tax being paid on the CPP in the year that you received it. You would not however have access to the funds and would have to pay taxes on them at a later date when you withdrew them from the RRSP. Doing this would just result in forgoing a portion of one type of future income (CPP) and replacing it with another type of future income (RRIF) – both of which are given the same tax treatment.

Before deciding to collect CPP early, you would want a through understanding of the chances of generating investment returns after fees, to give you an after tax RRIF income that would be greater than the difference in the CPP amount (after tax) you would received if you had taken it at 65 or later. To do this would require some complex calculations and a solid RRIF drawdown strategy.

If you are nearing retirement there are many decisions to be made – frequently these decisions are irreversible and will effect your retirement income for the remainder of your life. It’s important to have a clear understanding of your retirement income and know the tax implications of each source and your overall tax scenario. Seemingly small decisions that change your income over 30 or more years of retirement, can result in gains or losses of tens of thousands of dollars. Before you make these decisions it’s important to take a good look at your over all retirement plan. Here is a good place to start -https://www.canada.ca/en/financial-consumer-agency/services/retirement-planning.html

Working with a Money Coach is another great option. A Comprehensive Financial Plan will help ensure that you haven’t left any money on the table and that decisions you make today won’t have unpleasant repercussions in the future. The plan you create, guided by your Money Coach, will give you the confidence to know that you have made the best decisions based on your own personal circumstances.

Best of luck –

Christine

If I decide to take early Canada pension at 60 and still continue to work and contribute, will my payment increase at age 65 based on how much more I contributed since age 60?

Hi Virginia, the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

I was born in September,1959, started working in 1976, and by April 2020 I had to retire due my Bipolar 2 illness causing me to be too manic.

So can someone do my calculations and inform me what I am able to receive from the Canadian government as a long term disability Pension Plan receiver?

Hi David, the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

Do you think using the early CPP to reduce debt like high interest credit cards is a good option?

Hi Marvin,

I would say yes, if you are able to commit the CPP to pay down the credit card, rather than just spending the money …

Hi Marvin,

If someone has credit card debt the first thing that they should look at is the reason for the debt. If they have been living above their means, committing to a lower CPP income may not be the best or only solution. If the root of the problem is not addressed they could end up with a lower income going forward and still be relying on a credit card. A Money Coach can help you to build a solid spending and debt reduction plan – setting you the path to get out of debt and stay that way.

Great Information. I have a question, if you take CPP at age 60 and put it into RRSP ( considering you have room) and any tax reduction/ refund is used to pay down the mortgage? How would that work?

Hi Casey,

Let me elaborate on the tax implications of taking CPP and applying it to an RRSP a bit more.

Let’s assume you are eligible to receive $500/month in CPP starting age 60. If you were to take CPP, this would increase your taxable income by $6,000 a year (=$500 x 12 months). If you then were to apply the $6,000 to your RRSP, you would receive a tax deduction of $6,000, i.e. the net tax event of taking CPP and applying it to your RRSP is zero.

Conversely, if you were to apply the CPP benefits to your mortgage directly, you would end up paying tax on the additional $6,000 of income, but you could bring down the mortgage principal faster through the extra payments.

i have no dept no mortgage i also only have 60.000 in rsp should i draw cpp at 60 or wait

Hi Doug,

Congratulations on being debt free! It’s an excellent position to be in as you approach retirement. Determine what you would like your retirement lifestyle to be and continue saving toward your goal.

It’s so very tempting to take the CPP early! Best to continue employment until you close the savings gap. Plan to start your CPP after your employment ends. That way you avoid the early start reduction of 0.6% per month before age 65 and your employment will bump up your CPP entitlement. Also keep in mind that CPP is taxable so if you were to take it early it will be added to your taxable employment income. The result could be that you would pay a higher rate of tax.

Hi Barbara:

What are the rules regarding having CPP deducted from your pay cheque. In my reading I thought you could opt out of CPP only if you were collecting CPP. CPP deductions automatically stopped at age 70.

If you were self employed you could opt out of CPP at age 65.

What are the rules? Is the a website that has this information?

Any Canadian over age 18 who makes at least $3,500/year must make contributions to CPP, with few exceptions, such as for casual work.

You continue to pay into CPP until age 70, as long as you are still working. If you decide to take your CPP benefits at age 65 but you continue working, you may opt out of contributing to CPP.

Those who take CPP retirement benefits before age 65 and continue working, are required to continue paying CPP premiums.

These rules apply both for employees and self-employed individuals, except that self-employed individuals pay both the employer’s and employee’s share of the CPP premiums.

For opting out of CPP contributions between age 65 and 70, you need to complete form CPT30 (employees) or Schedule 8 CPP Contributions and Overpayment (self-employed individuals).

For more information, see:

http://www.taxtips.ca/seniors/cpprules.htm

Fyi: If you are still working at age 65-70 It is a requirement to be in receipt of CPP in order to opt out.

Top of CPT30.

Use this form if you are an employee who is at least 65 years of age but under 70, you are receiving a Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) retirement pension

Personally, I use the common sense approach and these are my reasons why everyone should take out their CPP at 60 instead of waiting until 65 or later.

1. Its extra income if you are in a situation where you need it.

2. Break even is not until you reach 74 and most certainly we can all enjoy the money much more (health & lifestyle) at 60 compared to waiting until 65 to take it out.

3. If you are fortunate enough not to need it at 60, simply put it into a TFSA which with the added interested will push the break even date even further.

4. Finally, and perhaps most importantly, sadly there are many people who pass away between 60 and 65 and for those who do, wouldn’t receive any amount.

For all these reasons I will never be convinced its in the best interest for anyone to wait. Having said this, its their money and we are all responsible for making our own choices. Good luck to everyone.

I agree with Gregg, take it while you can ,I am in my mid 50’s ,I am seriously thinking of taking mine when I reach 60, I have had so many people in my life,family and friends that never reached 60 and lost out on all the contributions that they paid into since they were 18 or younger, you work hard every day ,you look forward to the day you can retire,to enjoy a few good years of rest, relaxation and travel . Thanks for the information Gregg ,it sure made my decision a lot easier. Janet

I agree with Greg and Janet. I am planning to retire when I’m 60. I want to enjoy my quality years of life than quantity. Life is too short you need to make the most of it!

Thanks for all this relevant information ☺️

Michele

Hi Greg and Janet,

The timing of taking your CPP really comes down to individual choice and taking CPP early or later can make sense depending on your personal circumstances.

While many people feel as you do that there is benefit to enjoying your CPP in your earlier retirement, many others feel that delaying their CPP is like insurance on longevity. While some do not live long enough to get a reasonable return for the money they put into CPP, there are also people who live long enough to regret taking it too early and wished they had delayed.

People who delay CPP will often prefer to have a larger portion of their retirement income fixed and indexed in their later years when they may not feel as confident in their ability to manage their investments and make decisions on drawing down their nest egg.

Delaying your CPP does not necessarily mean reducing your annual income in early retirement. For many people it just means drawing from other sources, such as RRSP’s and TFSA’s or Unregistered Funds until you are ready to draw an increased CPP benefit.

Factors such as access to employer pensions, risk tolerance, a history of longevity, future reliance on CPP survivor benefits and whether you feel the need to leave a substantial inheritance to the next generation can all contribute to peoples decisions to take CPP early or late.

Really, without knowing when we are going to shuffle off this mortal coil, there is no right or wrong answer. A Money Coach can help clients come to a decision that they are comfortable with – the rest of it really is up to luck!

Gregg…your comments helped me make my decision. I am taking it early so I can use it for travel while we still can. You never know!!

I am collecting survivors benefit from Cpp is it still a good idea to take my Cpp at 60? I am planning on working until at least age 61.

Hi Sharon,

Your CPP survivor benefit is one source of income, wages/salary from your job is another one, and you may have additional sources of income.

Whether or not you should start collecting your own CPP benefits at age 60 depends on your personal situation. If you keep working to age 61, you may not need to draw on your own CPP benefits for your day-to-day living expenses at age 60. But there are other factors to consider, e.g. do you have debt(s) that you wish to retire before you retire? How is your overall health? What is your lifestyle going to look like in the first years of retirement? Some people are contented to live frugally while others want to travel extensively and therefore need the extra income. These are the types of questions to answer before you make a decision.

My blog post provides a numerical breakdown on how much lifetime payout to expect when taking CPP at different ages. For healthy women the lifetime payout is almost always larger if you defer taking CPP until age 65 or even beyond. This is because women, on average, have a longer life expectancy then men.

But please keep in mind that this is just a mathematical evaluation – you need to determine which option is the best for you personally!

Interesting article, in my case I am currently receiving a Defined Benefit Pension from my service in the Army. Part of my penison is a Bridge Benefit which is the smallest amount of the pension compared to the lifetime benefit, both together give me a set monthly amount. Enough on that :), when I reach 65 the Bridge Benefit amount ceases. The term often used for this is “Clawback”. At this point I have not figured out if it is better for me to take CPP early and bank the money monthly in my TFSA or wait until 65 to take the higher CPP amount. Of course if I knew how long I would live that would make it an easy call.

* My Bridge Benefit portion amount is approx $365 monthly, don’t have my statment handy. Comments and input welcome.

I did forget one important thing, my pension is indexed at age 60. No idea what the monthly increase we be as they use a number of factors in determining that. My guess is a couple of hundred dollars.

Hi Paul,

A bridge benefit is a payment that is made to members of many public sector pension plans who retire prior to age 65. In many cases, it is roughly equal to the unreduced CPP benefit, and it is paid until age 65. In other words, the bridge benefit allows you to claim the full amount of your CPP pension early, without any penalties.

The best use of the bridge benefit, in combination with a defined benefit pension plan and CPP, is to keep collecting the bridge benefit to age 65 (you are already doing this!), and at age 65, to start collecting your unreduced CPP benefit. As the amounts of the bridge benefit and CPP pension benefits are similar, you can enjoy a steady pension income while retiring younger than the regular retirement age of 65.

If you take the cpp at age 60, does it increase at age 65?

Hi Barb,

the CPP benefits are indexed for inflation. The cost of living adjustment is 1.3% for 2017. Other than that, you will not see an increase in the benefits at a certain age. If you start collecting CPP at age 60, you will get lower monthly benefits, but for a longer period of time, as CPP will be paid for the rest of your life. If, on the other hand, you start collecting at age 65, the monthly benefit will be higher, but you will receive 5 years less of CPP benefits than someone who starts collecting at age 60 and has the same life expectancy as you.

I have just applied for early CPP – I will be 64 when I start to receive it. I also work. This extra income will probably cause me to owe taxes when I file my income taxes. I don’t want to owe taxes. Where is the best place to invest this extra income to avoid owing taxes at the end of the year? RRSP????

Hi Vanessa,

Yes, correct, once you start collecting CPP benefits, your taxable income will increase by the amount of the benefits. However, if you do not need the benefits for your daily living expenses and you have RSP contribution room available to you, you may contribute the entire amount of the CPP benefit to your RSP, to have your taxable income reduced by the amount of the CPP benefit. The net effect on taxes is then zero.

Hi Vanessa,

If you have applied for early CPP and are having second thoughts, you can cancel your CPP benefit up to six months after your benefit starts. If you act quickly you may still fall within that window. You will have to do it in writing and pay back any benefits that you have received.

Before you make a decision to cancel or continue your CPP, it would help to have a good understanding of the options you have for drawing income in retirement. A Money Coach can help you build a plan for retirement that takes into account your expenses, the different types of income that you might have and tax implications of the choices you can make.

The decisions that you make today may effect you for 30 years or more. It’s worth taking the time to fully understand the options you have.

I turned 60 and decided to take my cpp but still working, will my cpp increase when I turne 65?

Normalin

Something else to note. Your CPP is taxable income on top of your working income so you’ll be paying higher taxes now, while getting a lower CPP amount for life (because of the reduction for starting it early). It’s better for you to wait until you stop working to start your CPP.

It may not be too late to reverse your decision. Contact Service Canada and tell them you would like to return your CPP benefits and restart it later at a higher amount.

Hi Normalin,

As I mentioned in an earlier comment if you start collecting CPP at age 60, you will get lower monthly benefits, but for a longer period of time, as CPP will be paid for the rest of your life. If, on the other hand, you start collecting at age 65, the monthly benefit will be higher, but you will receive 5 years less of CPP benefits than someone who starts collecting at age 60 and has the same life expectancy as you.

I am turning 60, I am receiving $250 survivor’s benefit. I am not planning to work, want to take early retirement and my pension will be probably about $250 at 60.

Will I still receive full survivor’s benefit?

Could I also receive survivor’s allowance when on CPP?

I did online research, the answer to the above questions are:

No, combination of survivor benefit and CPP is smaller than the sum of those.

Eligibility to survivor allowance is re-assessed every year, you need to qualify and meet the requirements – age, income, etc.

I’m 63 and still working although more low key. If I postpone CPP and am lower income (no company pension) will I be able to collect GIS at 65. My concern is that GIS is not taxable and is more than what my CPP would be at 65 therefore would be better than taking CPP at 2/3 of GIS and, taxable. I’m on my own and single seniors are most stretched (was a single working mom).

Thank you

Hi MaryAnne,

Readers are invited to share their comments; however the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

Diana,

I suggest you contact Service Canada to get a proper calculation of your CPP benefit starting age 60 & also starting at age 65 – for comparison sake. This is an important decision as your CPP is reduced by 36% if you start 5 years early and never goes back up.

You may be eligible for Allowance for the Survivor from age 60 to 64 if your previous year income is less than $23,616. Your CPP benefit is included in this income-test so will reduce your Allowance benefit.

Planning to work longer and delaying the start of CPP is an option worth considering.

does it make sense to collect cpp at 60 while i am still working ant making 70000 yearly income

Hi Tom,

As Tom Feigs mentioned above: “Your CPP is taxable income on top of your working income so you’ll be paying higher taxes now, while getting a lower CPP amount for life (because of the reduction for starting it early). It’s better for you to wait until you stop working to start your CPP.”

Margaret,

There’s nothing wrong with continuing employment to whatever age you desire. It keeps you busy and connected to the community. I trust this means you are in good health.

It sounds like you are lamenting starting CPP at age 65 and wondering if you should have started it at age 60. In the vast majority of cases earning income beyond age 60 suggests you should delay starting CPP until employment ends or you reach age 65. You get a higher CPP entitlement for life and pay less income tax. If you would have started CPP at 60, your CPP monthly entitlement would have been much lower at approx $600 for life (due to the early start reduction and less still because employment between age 60 and 65 would not have fully counted). You only have to reach age 74 to have the total payments from “CPP start at age 65” catch up to “CPP start at age 60”.

Starting CPP earlier could make sense ONLY if your annual gross income FOR LIFE is greater than $95,000 because this causes enough of an Old Age Security clawback (reduction) that is more than the CPP extra benefit.

Thanks for the excellent, comphrehensive, answer to Margarat’s question. Really made the decision parameters clearer to me. Just to be crystal clear, the 60 or 65 decision is probably best made after you know what YOUR amounts would be at both ages, right? (And then factor in your current employment income & your typical roi on rrsp contributions, to make your ‘best’ decision. Tkx!

Hi Will,

I’m glad you found this informative.

Longevity remains the biggest factor regarding when to start CPP which is indicated when you review what YOUR entitlement would be at age 60 compared to age 65. Worded differently then your comment but the same result.

Other factors include taxable income from other sources and when employment income stops. Work with a Money Coach to examine your path to retirement.

Hi Margaret:

You mention that you are not feeling well prepared for retirement. However, postponing CPP to age 65 and continuing to work has been a lot more beneficial for you than had you decided to take CPP at age 60. Had you started at this time, you would be receiving only in the range of $600/month (for life). So I think your decision to wait with CPP to age 65 and keep working beyond this age was wise, from a financial point of view! You cannot undo it, but it was a good choice and there is no need to second-guess yourself.

Hi, the information posted here has been very helpful, thank you. At age 55 I decided to draw my pension from a company I worked at since age 17 to 44. I am also receiving survivor’s benefit since age 40. I currently have part time employment at a much lower wage than my wage at the company. If I choose to start my CPP benefit at age 60, will the amount I receive be based on my ‘best ten years’ contributions even if I continue to work part time at much lower wage? This year I owe $2,654 in taxes, I have asked my current employer to deduct an extra $100 per pay. Thank you for your input.

Hi Corinne

The CPP entitlement is not calculated the same as a company pension plan. All of your years of employment between age 18 and 65 equally count towards your CPP. In each of your working years, you make a contribution to CPP as a percent of earnings and capped at the Yearly Maximum (2017 = $55,300). If you earn this Maximum in a given year, your CPP receives the maximum credits. If not, the credits will be proportionally less. Your worst 8 years of earnings don’t count to give you a higher entitlement.

You must be aware how many of your working years are “lower earnings”. If you choose to work part time or not at all for any years up to age 65, they would potentially use up those 8 years that don’t count (besides other provisions). Most Canadians don’t reach the maximum CPP entitlement due to too many low or no earning years. On top of that, starting CPP before age 65 causes a further drop of your lifetime entitlement of 0.6% for each month ahead of age 65.

Your part time income is not going to adversely effect your CPP entitlement any more then not working at all and/or starting CPP early. I suggest you continue working and delay starting CPP to as close to age 65 as you can manage.

Barbara

Thanks for your support to us all for this complex issue. I have just turned 60 and will continue to work for the federal Govt for the next 3 years. I also receive an indexed military pension on top of my salary from working. Would it be better for me to take my CPP now or wait until 65 at which point I understand there will some sort of clawback? I know that taxation will take a portion of this amount while I continue to work but I hear many of my colleagues argue for taking the CPP now while I still can? What would you recommend.

Hi Bob,

thanks for the interesting question. There are a few things I do not know but let me assume that as long as you are working the government job and are also receiving the pension from the military, you will not require the CPP benefits to cover your cost of living, correct?

The CPP retirement pension is considered taxable income, i.e. it will be added to your other sources of income and the taxes you end up owing will be calculated on all sources of income combined.

From a taxation point of view it would make more sense to postpone drawing on your CPP benefits until you have retired from your government job. While at this point you will likely be receiving two pensions (one from the military, one from the government), your income will not be as high as currently (actively working and military pension). I would therefore recommend that you wait to draw on your CPP benefits until you have ceased working.

There are of course other factors to consider, such as your overall health. But for a healthy person it makes sense to delay drawing on CPP benefits to age 65, to achieve a higher lifetime payout.

A clawback may happen at the level of OAS payments. This applies to persons whose net income is in excess of $74,788 (for 2017). Such a clawback (if applicable to you) would not happen until you reach age 65, when you will be eligible to receive OAS.

I collect CPP starting at age 60. I still work and contribute. Will these contributions increase my monthly payout the closer I reach the age of 65?

Cliff,

Working and contributing to CPP while already collecting CPP benefits is referred to as Post Retirement Benefits (PRBs). These PRBs are added on to your age 60 main CPP entitlement. They appear one year delayed as they are calculated based on the previous year’s earnings.

PRB is calculated as $Earnings X 25% up to max entitlement ($13,370 in 2017)/40 and factored down by 0.6% X number of months ahead of age 65. Each year earned is a new lifetime up tick in your entitlement.

You would get CPP age 60 + PRB age 61 + PRB age 62 + PRB age 63 + PRB until age 70 or until you stop earning. It gets progressively larger as the years accumulate.

While PRBs are a welcome extra benefit, they do not come close to replacing the CPP reduction factor by starting your main CPP entitlement at age 60 instead of waiting until age 65 assuming you live beyond the break even age of 74.

Dennis

My wife turns 60 in August 2017 and can take early retirement . She wants to work to the end of March 2018. Would it make more sense for her to wait the extra 7 months before starting her CPP or take it early starting in September and contributing PRB for the 7 extra months she will work?

Hi Dennis,

as discussed in the blog post, it almost always makes sense for healthy women to delay drawing on CPP benefits. This strategy will result in a higher lifetime payout. From this point of view, it would not only make sense to wait the extra 7 months until your wife retires in May of 2018, but to wait until she reaches age 65.

There are of course other considerations, such as her health and whether or not you will need the CPP benefits to support yourselves once your wife is retired. I do not know the answer to these questions and therefore cannot give a recommendation, but everything else being equal, it does make sense to delay taking CPP benefits.

Dennis,I have been receiving disability payments for 5 years thru work. I did not qualify for CPP disability. I worked 15 years part time while raising 4 kids then 15 years full time and at the end of my career when became disabled I divorced. Insurance wants me to reapply for CPP disability and I am very doubtful it would be accepted. I feel pressured by the insurance company as you probably know any CPP payment would decrease their contribution. However, I am no longer contributing to CPP and wonder if I should apply for regular CPP benefits. Thanks,Donna

Hi Dennis, my uncle is 72 years old. Retired 2 years ago and never consider of applying for CPP?! After discussing with him, he wants to know how much he would get before applying for it. Government has form to estimate request for CPP up to age 70 only. Can he still request to get an estimate of how much he would get?

Thanks, Bella

Hi Bella,

your uncle should apply for CPP pension immediately. Delaying the uptake of CPP benefits beyond age 65 results in increased monthly payout, but only up to age 70. If he waits beyond age 70, the payout on the CPP benefits will not increase further. For this reason it makes the most sense to start drawing on the CPP benefits without any additional delay.

Your uncle can obtain information on his estimated CPP benefits at the My Service Canada account:

https://www.canada.ca/en/employment-social-development/services/my-account/cpp-oas-information.html?

In order to start drawing on the CPP benefits, he needs to apply. The benefits will not get paid out to him automatically.

I started taking my CPP at age 60. I will be 63 in September 2017. I hope to work past age 65. Can l still return my CPP and start collecting at age 70? Pls advise

Thanks.

Hi Azmina,

unfortunately, once you have started taking your CPP retirement benefits, you are locked in, i.e. you will be receiving the benefits for the rest of your life. You cannot pay them back and commence taking them again later in life. However, since you haven’t left the workforce, you can opt to make contributions to CPP after age 65 (up to age 70), which may increase the monthly payout of your CPP benefits.

I have just retired early at 59. My online CPP statement provided the monthly retirement pension that I could receive if I were 65 today. Approximately how much would my CPP payment be reduced if I take it when I turn 65, which is 6 years from now? Would the reduction be less if I take it at 60?

If you were to take your CPP benefits at age 65, the amount would not be reduced, i.e. you will be receiving the amount that is provided on the online CPP statement, plus an inflation adjustment. Conversely, if you were to take up CPP early (at age 60), you would be looking at a 36% reduction compared to taking it up at age 65. This is because you will be collecting CPP for five years longer (starting at age 60 vs. starting at age 65).

Hi Barbara

The online (and hard-copy) estimates that CPP provides “pretend” that a person is already age 65 at the time of the estimate. This has the same effective of projecting their current “average lifetime earnings” up until age 65. If instead they plan to have zero earnings for some years, their actual CPP amount at age 65 could be reduced by up to 2% from the estimate, for each year of zero earnings. For AW Chung, that means that his actual CPP when he reaches age 65 could be as much as 12% less (ignoring the inflation adjustment).

Thank you, Barbara! I was worried that since I won’t be contributing to CPP in the next 6 years, that will reduce my average contribution and thus my benefit when I am ready to take it. Your information is most helpful. Thank you again.

My question is, I am 60 years old with full time employment. I do not need the extra income cpp will give me. If I take cpp now and invest it in a tfsa and pay the extra taxes that I can afford now, is this a profitable option for me, or is it best to leave it until I retire because the monthly amount will be greater then. I think longevity runs in my family, my mother just passed away at age 89

Hi Vicki,

Readers are invited to share their comments; however the author is not able to address questions regarding an individual’s specific financial situation. If you have a technical question regarding your CPP, please contact Service Canada. If you would like to discuss your retirement planning needs, we encourage you to book a free, initial consultation with one of our Money Coaches.

Hi Barbara,

My question is with respect to my mother. She just turned 60 and is inquiring about taking her early retirement now, she did work for about 15-16 years and always made her contribution but then was let go and received a package from the company she worked for and the money was locked into GIC’s I think. She has not worked for the past 13 or so years, is it beneficial for her to take her retirement monthly payments now?

Vera, it is difficult to answer your question with the information you provided. I would recommend that your contact a Certified Financial Planner to have these questions answered. Each individual situation is different. A number of our coaches provide retirement planning services, please refer to our website to find a coach that’s right for you.

Hi Barbara,

I am about to turn 60, and was fortunate enough to be able to retire at age 54. I am healthy and work part time which generates $8,000 in income a year. Because my CPP contributions have been very low the past 6 years, does it make sense for me to take CPP early? I want to avoid any long term reduction of my CPP monthly pension as a result of adding 5 more “low earning years” to my CPP contribution history if I were to wait until 65 to start receiving CPP. I already have 6 low income years from ages 18-23 when I worked part time while at school, but have worked full time and contributed the maximum CPP annually from 1982 to 2011. Thank you.

Hi Kathryn,

Congratulations on being healthy and in a position to retire early.

If you are able to continue to fund your lifestyle though part time work and or other means, delaying your CPP to 65 will greatly increase your monthly CPP benefit. If you would like to delay until 70 your benefit would most likely be more than double what it would be at 60. Maximizing your CPP benefit, however may not necessarily maximize your retirement income.

Based on your question it seems unlikely that you have had a planner create an overall retirement plan for you. Working with a planner can help you time converting your RRSP to a RIF and collecting your CPP and OAS.

Someone who retires at 54 has a long retirement ahead of them. Without an overall plan, the decision to draw income from RIF’s, TFSA’s, Unregistered Funds,or to start CPP and OAS benefits can be daunting. Consider working with a Money Coach to look at maximizing your income, reduce taxes and avoid benefit claw back- you will be glad you did.

Hi barb

I contributed a maximum CPP for 30 years,

Retired at 61,

Comfortable with my pension amount from my company,

If I collect CPP now, I will get 732$ a month…

Will I get more if I wait age 63?

Hi Placide,

At age 65 a person can receive their full monthly entitlement for CPP. The monthly benefit that you would receive would be based on how much you contributed between age 18 and 65. If you take your benefit at age 61 you would only receive 71.2% monthly of what you would have received if you waited until 65. If you are able to wait until age 63 you will receive 85.6% monthly of your full entitlement. At 65 you would receive 100% of your CPP benefit. For those who are able to delay their benefits beyond 65, they can receive an additional bonus. The maximum that a person can receive is 142% of what they would have got monthly if they started collecting at age 65- but only if they wait till age 70.

If you are comfortable living off your company pension, waiting until age 63 (or later) will increase the monthly benefit that you receive. The question to ask yourself is what will you do with the extra income at age 63? If your company pension is not indexed perhaps you can use the extra income later to off set inflation. Taking CPP later can also help off set higher medical costs in later life. Since you have retired early you may also be receiving a bridge as part of your pension. This bridge will usually end at age 65. If this is the case you may want to wait till age 65 until taking CPP.

If you feel that these costs are adequately covered and you think that extra income would be useful now you could start collecting the lower monthly benefit now.

Even though you are already retired, working with a Money Coach to plan your retirement can still be beneficial. Not only do you have the timing of your CPP to decide on, you also have the option to delay OAS. If you have RRSP funds you may also have yet to decide on the timing of converting it to a RIFF. You may also have TFSA and unregistered funds to draw on and have to decide what is the most tax effective way to do this. All of these things will need to be balanced with your goals and what you want to do in your retirement. Having a game plan can help.

If I take my CPP at 60 and keep working and paying CPP till I reach the age of 65 will my CPP

increase each year because I am still paying into it or not, and if so how much will it go up by each year. Does the CPP go up each year due to inflation or once your start taking it that will be the amount for the rest of your life

Hi Jeevan,

If you begin to collect CPP at age 60 but continue to work, you and your employer will need to continue to contribute to CPP. This will result in Post Retirement Benefits (PRB) which will be added to your main CPP payment annually.

If you collect it at age 60, the main portion of your CPP benefit (the portion you earned from age 18 to 59) will be subject to the early CPP penalty of 36%. Your PRB will also be subject to reductions because you will be collecting them before age 65.

The maximum PRB you could receive (in 2017 dollars) would be around $334 per year before the reduction for taking them early is applied. The percentage that your PRB’s are reduced by will get smaller each year as you get closer to 65. The PRB’s you earn age 60 will be paid out starting age 61 with a reduction of 28.8%, the PRB’s earned age 61 will be paid out starting age 62 with a reduction of 21.6% etc. until finally the PRB you earn age 64 begin being paid out with 0% reduction aged 65.

Your CPP benefits will also be subject to indexing. Each year in January CPP benefits are increased based on the Consumer Price index. This helps to off set inflation.

Continuing to contribute to CPP after age 60 will increase your benefits by a small amount, however, it will not come close to making up for the 36% reduction on the vast majority of the benefit you have earned from age 18-59. If you are still working and do not need the additional income, consider whether delaying CPP might be a better solution for you – A Money Coach can help you with your decision.

Great thread and comments from all. Many thanks!

There is one consideration that I think is very important and I have not seen anyone comment on it.

Hypothetical scenario: Married man dies at age 61. He was waiting until age 65 to start collecting his CPP… Question: How will this affect his wife’s survivor’s benefit? Will she be able to collect any of his CPP pension as a survivor?

CPP is a life time benefit that is designed to support the majority of people living well into their retirement years. There is flexibility to start the benefit anywhere between age 60 and 70. Service Canada set the reduction at 36% for early start of CPP at age 60. This mathematically makes starting CPP at age 65 more desirable for most. You only need to reach age 74 to get to break-even after which starting at age 65 is the better choice. 9 out of 10 males will survive to age 60 and 2/3 will survive to age 75. Average life expectancy is 83. According to Stats Canada.

In the unfortunate case that a married male is deceased at age 61, the spouse receives a survivor CPP benefit that is based on a portion of the deceased entitlement depending on spouse’s age, number of dependents, and spouse’s disability. This survivor amount is added to the spouse’s entitlement and capped at the maximum entitlement for one person. I will leave out dependencies and disability in this explanation.

The deceased entitlement is calculated first. The average CPP payment for new beneficiaries is $643.92 which is much lower than the theoretical maximum of $1114.17. Let’s say for illustration purposes the deceased male earns a CPP entitlement of $700 per month at his age 61 (above average). If the surviving spouse’s age is under 65 and has not started her own CPP pension, her survivor entitlement would be 186.51 + 700.00 times 37.5% = 449.01 per month until age 65 plus inflation. At age 65, the survivor entitlement would then be 700.00 (with inflation adjustment) times 60% = 420.00. This is added to her pension but the total cannot exceed 1114.57 (2017)

The survivor would have choices regarding her CPP depending on her own entitlement amount, other taxable assets, her age and company pensions plans. This is a good time to confer with a professional to make optimal choices.

I have been receiving CPP since July of this year. I know I should be paying taxes out of this amount, problem is that I don’t know how to calculate the proper amount.

I have heard it’s best to get a financial Adviser, but I don’t have the means to pay a large amount. I only need to know the amount that I should be paying the Government.

Thanks in advance, much appreciated!

Hi Sandy,

You are correct that the CPP benefit is taxable. You can voluntarily have income tax deducted from your CPP payment. Simply download form ISP-3520 from the Service Canada website to make this voluntary election.

A good way to anticipate how much tax you will need to pay is to refer to the Tax Resources on our website: http://moneycoachescanada.ca/resources/tax-info/ This will allow you see what tax bracket you are in and help you decide how much tax should be deducted from your CPP.

For most of us, CPP and OAS is a portion of our retirement picture. Consider working with a Money Coach to ensure your financial resources are matched well with your desired lifestyle.

The question I have was already asked but not adequately answered. I am retired (aged 61) will little prospect of any earned income before age 65. I have only contributed in 36 yrs, not all of those at max either. I also have several years with zero CCP contribution with a few more to be added to that total. Will the next few years of zero contributions reduce what is currently calculated for benefit if I wait til 65? It is already well below max. If it can drop further then that just may take it early.

Joe,

The calculations that determine your CPP entitlement are based on your income of your entire working life. Each year that you earn or do not earn income has a roughly 1/40 (2.5%) maximum impact on the final CPP benefit amount at age 65. However, the penalty for electing CPP early has a much greater impact of 7.2% per year.

When you elect CPP early, those future years between your election date and age 65 are dropped out of the calculation. This effectively anchors your entitlement (it doesn’t go down). The problem is that you are also penalized for the early election. This penalty outweighs the benefit to elect to start early.

Your expected life span remains the biggest determining factor. For most Canadians living an average life span into your 80’s, taking CPP at age 65 gives you a higher cumulative benefit.

Your other financial means such as savings, assets, pensions could weigh in on your optimal CPP election decision. Consider working with a Money Coach to ensure your financial resources are matched well with your desired lifestyle.

I recently applied for CPP on-line through MyAccount and received confirmation through the mail. However, I am not sure if this included an automatic application for the child drop out years. I believe I was asked questions about children, etc. Do I still need to make this application separately?

Hi Lynda,

if you are already receiving CPP and you are not certain whether your dropout years for raising your children have been considered, you may apply for child rearing provision using form ISP1640, and mail it to Service Canada as indicated on the form. (link below) or contact them directly at 1-800-277-9914.

https://catalogue.servicecanada.gc.ca/content/EForms/en/Detail.html?Form=ISP1640

I am lucky enough to have retired at age 54. I receive a good indexed military pension after 35 years of service. I do not plan on working again, I want to enjoy my retirement while I am still fit to do the physical things I want. When I retired the financial counseling that we received during a two day course definitely told us all that we should take CPP at 60 due to our bridge benefit and choice of an early retirement. I really don’t understand the math about the 2.5% impact. By my calculations the six years of not working until I reach 60 plus the 4 years I had with too low of an income when I entered the military add up to 10 years x 2.5% = 25% reduction of my CPP but I can throw away 7 years of non contributions, so I really would only have 3 x 2.5% or a 7% penalty. However if I wait until 65 then my penalty due to non contributing years will increase by 5 years to 8 in total x 2.5% = 20%. I understand that by taking CPP at 60 I will have a 36% penalty but collect for those five years in addition to my bridge benefit, so the math works out to take CPP at 60 does it not?

Hi James,

Thank you very much for serving our country! You are rewarded with early access to a pension with bridge benefits. CPP is an entitlement anchored at age 65. You can choose to elect CPP earlier by 5 years which allows those years to be dropped from the entitlement calculation but the early reduction factor is also applied. There will be a higher entitlement at age 65 no matter the personal situation. The question is: When does the accumulated 65 entitlement catch up to the 60 entitlement? In the most extreme case, the catch up (break even) happens before reaching your 80th birthday.

If you received guidance pre-2016, it is no longer valid as the reduction factor was increased.

CPP is a lifetime benefit that performs best if you have an average to long life span

Starting CPP at age 65 is better than starting earlier if you have an average to long life span

Consider working with a Money Coach to ensure all of your financial resources are matched well with your desired lifestyle.

I haven’t paid max CPP into the plan for 40 years because of my early years not making much income, so won’t get max CPP. I am 63 and will not work again because I have enough savings. My understanding is if I DON’T take it early I get more of a hit from what is listed in “The statement of contributions from Service Canada” (SOCFSC) than just the .6% per month that occurs if I take it early. The reason for the “extra hit” is the SOCFSC assumes I will continue working at my last year’s wage until 65 so it creates some likely CPP contributions in its calculations that won’t happen.

I would like to know if I wait until April 2018 when next year’s tax return is due if I will get the full SOCFSC less .6% per month cut or do they do a retroactive calculation once I file a zero employment income return for 2017? If no retroactive is done until a tax return is filed, when is the latest that I can apply for early CPP without getting a retroactive adjustment, considering 2017 return is due end of April? I am not planning on gaming the system with a bogus tax return that I amend later, just want to know about the deadlines regarding the “extra hit”.

Hi Steve,

The Statement of Contributions from Service Canada ASSUMES you are age 65 this year. Those of us that are not age 65 this year must view this statement as general information only. Think of it as a quote. The final contract is what you get (when you apply), and could be higher or lower than the statement suggests. Attempting to estimate your actual CPP based on this statement is not helpful to decide whether to elect to start sooner or later. There are NO “additional assumed contributions”. It’s more of an average weighting over your entire working life + drop-out year factors. The reduction caused by adding zero earning years could be mild or nothing at all. This reduction will certainly be less than the reduction caused by starting CPP early.

You can get a current estimate of how much you’ll receive by contacting Service Canada (servicecanada.gc.ca, 1-800-277-9914). You can also ask for an alternate estimate at a later age with zero earning years to compare the two. Why guess. Get the real answer.

When Service Canada receives your application, your actual CPP entitlement will be calculated from previous annual earnings + earnings in current year (if you apply mid year). This CPP entitlement will be adjusted in the following year once the tax year concludes. So there is no opportunity to strategize as to the timing of a CPP application.

Work with a Certified Financial Planner or Money Coach to ensure you have saved enough, to structure your financial resources to minimize tax, to develop an effective withdrawal schedule and to shape a comfortable retirement.

My wife’s employment income was around $50k in 2017 and she is planning to take CPP early around May 2018, so she should wait until RevCan has processed the 2017 income tax return so she gets credit for contributions made in 2017 when the CPP guys do their calculations. Do you know how long after she receives her Notice of Assessment it will take the CPP guys to get the data into their system?

Hi Steve,

If your wife is not entitled to the maximum CPP benefit, you may want to reconsider electing to start CPP early. It’s usually better to wait until age 65 in the long run.

Her CPP benefits will be calculated based on the date of application. Service Canada will use previous year averages to estimate her final year entitlement. Later on, when the tax year is complete, Service Canada will adjust her CPP benefit to properly reflect her actual earnings.

According to Stats Can:

A male at age 65 has an average life expectancy to age 83.5 (2015)

A female at age 65 has an average life expectancy to age 85.6 (2015)

There are no employment earnings scenarios including zero earnings years after age 60 that stretch the break-even age (comparing CPP at 60 to 65) beyond age 79. Indeed, most CPP applicants will be contemplating a break-even age of 74.

There are factors that influence your decision such as personal health and expected longevity. The majority of golden age Canadians will find they would have been better off starting their CPP entitlement no earlier than age 65.

I am a 59 year old female who just retired early from teaching and have a small pension. This pension at age 65 is reduced due to its tie in with CPP.

So I was wondering since I have an income gap- should I take CPP at age 60 or is it better to use some of my principal? I also was wondering if I should take CPP at age 60 because my teaching pension is not lowered if I take CPP from ages 60- 64?

Hi Alisa,

These are all good questions but we can’t give specific advice on your situation. If you are interested in learning more about our retirement planning services please book an initial consultation with one of our money coaches: https://moneycoachescanada.ca/contact-us/

Excellent information. My question: I just turned 60 and applied for my CPP. I have been working full-time since 1978, but the first couple of years, my CPP contributions were low. I was also on two 6-month maternity leaves for each of my kids. When applying, I asked them to take away the 2 years that included my maternity leaves, which I assume they did. However looking at my contribution statement, I paid less to CPP & earned less between 1978 and 1981 than during the years I was on maternity leave. Can I ask them to take off 1978 & 1979 and the 2 years of maternity leave in the calculations…keeping in mind I have not contributed to CPP for 40 years (it will be in 2018). I have not received my first CPP payment yet….it will come Christmas time!

Hi Marie,

it sounds like when you applied for CPP you also applied for the Child Rearing Drop Out (CRDO) provision. This gives Service Canada the option of dropping additional years from your CPP calculation if your contributions were lower, not only while you were on maternity leave but all of the years when your children were under age 7.

Service Canada will not automatically drop all of the child rearing years, they will only do so if it increases your benefit – so you don’t need to worry about calculating which years you would like used for the calculation and which years you want removed.

If your child rearing years were not low income, you don’t get to pick additional lower income years to drop. You only have the general drop out provision and the option to drop the years that fall within the time frame when your children were under 7.

On a further note, the maximum annual contribution to CPP (and the income required to meet that maximum) is indexed annually and your benefit is calculated based on the percentage of the maximum that you paid into CPP each year. In 1978 the maximum employee contribution was $169.20 and anyone earning over $10,400 would have paid the maximum. In 2017 the maximum employee contribution is $2,564.10 and you would need to earn $55,300 to pay this maximum. Having 1978’s maximum contribution ($169.20) added to your calculation would have the same result as having 2017’s maximum contribution ($2,564.10) included. Again, Service Canada will calculate, which years are dropped in order to maximize your benefit so you don’t need to worry about working this all out.

Enjoy your Christmas with a little more jiggle in your jeans!

Christine

I am currently receiving a survivor benefit of $420 per month. I am considering whether to take my CPP benefits at age 60 and was looking for some insight into how the maximum CPP benefit may play into this. My understanding is the current 2017 maximum is $1114.17 at age 65. The combination of CPP and survivor benefits is capped at this $1114.17. Does this maximum of combined CPP and survivor benefits reduce down to $713.07 if you begin to draw at age 60? If it does then I am effectively only receiving a $293.07 benefit from CPP if I start to draw at age 60?

Hi Leonard,

You are correct that the total CPP entitlement (personal + survivor) does not rise above the maximum CPP entitlement for one person at any time. You will be pleased to know that the maximum CPP entitlement is fixed ($1114.17 per month as of 2017) no matter what age you are so $1114.17 would be your maximum even if you start CPP before age 65. To also clarify, your CPP survivor benefit is your entitlement now and for the rest of your life + indexing. The survivor benefit does not get adjusted down if you were to start your personal CPP before age 65.

The math in your case comes down to 1114.17-420=694.17. Once your personal CPP entitlement reaches 694.17 (with early reduction if you start CPP early), you will have reached the CPP max. That is the time to start your personal CPP benefit as it won’t get any bigger by waiting longer.

Our professionals at Money Coaches Canada would be pleased to furnish you with a comprehensive retirement income plan for the long term to ensure all of your finances are managed effectively.

I am in the same situation. I currently receive a survivor CPP pension of 587.81. I turn 60 next month and my Service Canada account says that if I take my pension at age 65 I will receive 1055.79, at age 60 I will receive 675.71. The lower amount of 675.71 + the survivor pension of 587.81 equals 1245.52 which is higher than the maximum of 1134.17. Am I correct in thinking I shouldn’t wait until 65 to take my CPP even though I will still be working and have to pay taxes on this pension (annual salaried income is around 67860)?

Hi Suzanne.

I am in a similar situation as well. Did you get any answer or make a decision?

Michael

Please see comments below!

Hi Suzanne,

Your CPP monthly entitlement is a maximum of $1134.17 (2018). You are correct that there is no additional benefit to wait to start CPP if your survivor + personal CPP benefits tally more than the $1134.17 max.

Continuing to work while collecting CPP allows you to earn Post-Retirement Benefits (PRBs) which will further top-up your CPP benefit.

Closing in on age 60 is a good time to work with a professional at Money Coaches Canada to evaluate all of your financial resources for your eventual retirement.

Hi Tom

Although it’s probably the same answer that you might receive from Service Canada.

The truth is, Suzanne’s choices are:

– taking her CPP at age 60 in the total combined amount of approx. $1,061.81, but that will reduce to approx. $960.49 when her survivor’s pension is recalculated at age 65 (In addition, she would earn PRBs as you said);

– continue to receive her survivor’s pension of $596.63 (2018 rate) until age 65 and apply for her CPP then, when she would receive a combined benefit of $1,134.17;

– continue to receive her survivor’s pension of $596.63 (2018 rate) until age 65 at which time it would be recalculated to $651.71. Wait until age 70 to apply for her CPP, when she would receive a combined benefit of $1,577.60;

These are very complex calculations, and anyone in this situation should know these 3 choices before deciding when to apply for their CPP!!!!!

Thank you Doug! I wasn’t aware of the Survivor Pension reduction I was going to face taking CPP before age 65. And thanks for the calculations and information you supplied in the report you prepared for me. I highly recommend Doug’s services if you are looking for these kinds of calculations! Done very promptly and efficiently and well worth the small cost and helped me make a decision to defer my pension for now. See http://www.DRpensions.ca if you are interested.

I am in the same situation as well. I decided to take my CPP early with my survivors benefit for the following reasons.

2018 I received $1038/month. I am still working and in 2019, they increased my pension with the cost of living. A PRB (Post Retirement Benefit) of about $25-28/ month will be added in March.

I asked and received a written statement regarding my CPP/Survivors Benefit calculation when I am 65 and it was at the maximum level for a Single CPP person.

Every cheque I am receiving now goes into a RSP account which is paying an average of 5-8% return. This is neutral income, meaning I am not paying any additional taxes since it is in an RSP.

When I am 65, I will have anywhere from $50-$55,000 (at least).

Even if (according to the specialists here) I receive $100-200 less CPP payments, I will have an additional $100-130 in PRB payments.

Regardless of PRB benefits, 5% interest on $50,000 in RSP is about $2500 per year. More than the pending shortfall as explained. (Even though My letter indicates otherwise.)

Still, I suggest everyone to do their homework, determine how much RSP room they have available and be subjective of their lifespan.

Hi Tom

Tom, the actual answer is more complicated than it would appear. The “maximum” is applied using the “calculated” or “unreduced” retirement pension of the survivor and the “earnings-related portion” only of the deceased’s survivor’s pension. The effect of this is similar to what would occur if the maximum itself was reduced, but it’s not as simple as that. The best that I can offer is this link: https://retirehappy.ca/cpp-survivor-benefits/

Hi Doug,

Thank you for taking the time to share your expertise! We appreciate your understanding of the nuances of CPP survivor benefits. Decisions around CPP can be complex and making informed choices need to be made in the context of an individual’s circumstances and requirements.

Service Canada is a good place to get basic information, but it sounds like you are offering an excellent service and resource for those with unique concerns.

I concur completely!

Thanks for the thorough and timely analysis. I have a further complication in that I will be living in the US when I retire and drawing social security so I definitely need to speak to someone. I’m trying to find someone familiar with both US and Canadian systems including the social security ‘windfall’ provision since I am currently also drawing a military pension. Complicated to say the least. Thanks again and if you think you have the expertise to handle my situation please let me know and I’ll get in touch.

Hi Leonard,

May I suggest you gather as much cross-border information as you can about your personal government benefits starting at: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-international/united-states.html.

I would be pleased to assist you to put your pension benefits in context with your overall financial resources, please fill out our contact form here and ask for me: https://moneycoachescanada.ca/contact-us/

Hi am from thailand came to Canada 2001,now i am 57 years old and am still working .if I would like to apply CPP at age 60, how much i will get per month ?

Hi Mattana,

you will not be able to obtain full CPP because you have lived in Canada and made contributions to Canada Pension Plan for only for a part of your life. This is true for many people, I am also an immigrant who came to Canada in 2001!

The best way to get an estimate of how much you will be receiving in CPP is to obtain your statement of contributions and expected CPP benefits. Register online with “My Service Canada Account”:

https://www.canada.ca/en/employment-social-development/services/my-account.html

Here you will be able to access information on your anticipated CPP benefits. Note that it will provide you with an estimate only. To obtain more detailed information you may wish to work with a certified financial planner or contact Service Canada directly.

Lots of great discussion on when to take CP. My question is – I have paid the maximum into CP each year since age 18. Therefore I am expecting maximum payments. I am looking to retire now at age 61 but financially I don’t need the income from CP until 65 or later. If I retire now and therefore stop paying into CP for four years will my CP payout rate be reduced because I did not pay the maximum into CP from 61 to 65.

Hi Steve,

The CPP General Drop-out Provision allows you to drop out up to eight lower contribution years from your CPP calculation. If you have paid the maximum CPP contribution from age 18 to 61 then the four zero contribution years from now to 65 would be Dropped-out. This would mean that you would receive the maximum CPP benefit. Request your CPP statement of Contributions from Service Canada to confirm that you have contributed the maximum since 18.

Consider working with a Money Coach to create a Comprehensive Retirement Plan. If you have TFSA, RRSP or Non-Registered investments that you can draw on, you may have the option of taking income from them and delaying CPP (and OAS) later in your retirement. Having retirement draw down projections done, can help illustrate the impact of reducing your investments at a faster rate at the beginning of your retirement in order to meet your income needs. You can then compare that with a scenario where you take a reduced CPP at retirement and allow your investments more time to grow. Once you know the scenario that gives you the highest over all after tax income, you will be able to make more informed decisions.

Hope this helps

-Christine

I am not retired yet, I am 60 as of September of 2017. If I take out early CPP can I income share that with my spouse? And, should she die before me, would the full amount of the CPP revert back to me and continue until my death?

Hi David

Yes, you can choose to split your CPP income with your common law partner or spouse for the purpose of reducing tax. You simply fill out a form to declare the intent to split.

Should your spouse die before you, your full CPP entitlement reverts back. Also, up to 60% of your spouse’s CPP entitlement tops-up your CPP entitlement as the survivor.

Keep in mind, it’s usually not advisable to start CPP or split CPP income while:

– one or the other person is earning income

– you have other sources of taxable income that effect your marginal tax rate

– you have not reached age 65 to avoid the early start reduction.

Work with a money coach or financial planner to organize an optimal retirement income schedule.

Thank you

My wife and I are retiring in 18 months debt free.Our indexed pensions with be 72,000 combined until 65 and 92,000 after 65.The bump comes from OAS and the difference of bridge amounts and CPP.My question is should one or both of us take CPP early to equal out our retirement income over the entire period.I am two years older than my wife and will be 57 ,she will be 55.So when I turn 60 should I take the reduced amount? From the CPP estimator unreduced is 1095.00,reduced amount is around 700.00.My wives will be a little higher but two years later.We will have about 90,000 in rrsp for travel.

Hi Rich,

There are a few factors that weigh into starting CPP earlier compared to at age 65. Longevity is the most important one. If you feel you will live an average life span then waiting until age 65 would avoid the 36% reduction and you will receive more CPP benefits in the long term.

Consider drawing on your RRSP before age 65 to even out the taxable income so that you don’t have to start your CPP early and you will pay less tax in the long run. You can still budget for travel with the source of funds being changed.

Work with a professional money coach or financial planner to set yourself up for a worry-free retirement lifestyle.

My question is in regards to possible changes to the CPP program. Currently, all people are allowed CPP benefits. I will be receiving a pension from my employer when I retire (at 60). In deciding whether to begin receiving CPP at 60 or 65, I am curious whether the government can change the program in the future. They are always looking for news ways to increase their revenues and reduce their expenses. Could they say (in the future) that because I receive a pension that I am considered to be “rich” and therefore not in need of the CPP benefits? In that case, I would want to start receiving the benefits as soon as possible (age 60) so I can get some of the benefits before they change the plan.

Michel,

I cannot speculate on the future of Canadian legislation but please allow me to explain the governance of the Canada Pension Plan.

The CPP Investment Board http://www.cppib.com/en/what-we-do was established by an Act of Parliament in December 1997 with a mandate to invest the assets of the CPP Fund with a view to achieving a maximum rate of return without undue risk of loss for the benefit of 20+ million Canadians. This Board works in arms length from the Government.

Actuarial analysis is performed annually to ensure all future pension obligations are met and the CPP pool is in very good shape as of the most recent report: http://www.osfi-bsif.gc.ca/Eng/Docs/cpp27.pdf.

Funding comes from payroll deduction and not general income tax revenue. Funds cannot be syphoned from the CPP pool to be spent on other Government objectives.

Once you review the above, the only reasonable conclusion is the CPP pension is here to stay for a long, long time.

I will be turning 61 in march 2018. I am receiving CPP disability 800.00 a month plus workers compensation 1400.00 which will both cease when I turn 65 Last time I worked was in 2006 so I have not contributed to CPP. I will receive a lump sum payment of a little over 10000.00 from compensation when I turn 65 this money was set aside by them to cover pension loss. So my question is if I applied for CPP at 61 would I lose my CPPdisability and my workers compensation benefits. Also if my CPP benefit would be 600.00’a month at age 65 how much would I get at age 61. So confused as to what to do.

Hi Vera – Yes, you would lose your CPP disability pension if you applied for a CPP retirement pension, so you definitely don’t want to do that (you’re not even allowed to do that under the legislation, unless you’re no longer disabled). Right now, your CPP disability pension of $800 will convert to a CPP retirement of approx. $420 at age 65. If you were able to start receiving it at age 61, it would be approx. $299 (and again your CPP disability pension would end immediately).