By Sheila Walkington, Co-Founder and CFO of Money Coaches Canada

Set clear life and financial goals, live within your means and save a percentage of your income for the future. While these budgeting and planning principles still apply, the financial landscape has changed – perhaps forever. COVID-19 has rocked our world and changed how we live, spend, and save.

January is typically a time to set goals and intentions for the coming year. Given the past year we have had, I am particularly excited to set my new year goals. It is something I do annually with both my husband and girlfriends.

January is typically a time to set goals and intentions for the coming year. Given the past year we have had, I am particularly excited to set my new year goals. It is something I do annually with both my husband and girlfriends.

This year, the annual “Girlfriends and Goals” event was via Zoom. Not ideal, but an unexpected bonus because girlfriends from afar could join in. This year, my friend from Bowen Island and my sister in Toronto were able to participate!

Although many of us are happy to see the end of 2020, the pandemic isn’t over. 2021 is still filled with uncertainty politically, economically and socially, which makes formulating a financial plan a little more challenging.

While my goals haven’t changed all that much this year compared to last – travel (when allowed), health, and quality outdoor time, David and I are adding home improvements to the mix this year. With more time at home, the desire to spruce up our living space is coming to the forefront and encouraging us to rethink and shift our priorities on how we budget our money going forward.

Here are five areas that are impacting budgeting decisions for many professionals and small business owners like ourselves.

1. More Uncertainty, Stress and Vulnerability

The pandemic is taking a toll on our financial confidence. 30% of Canadians surveyed by FP Canada are concerned they won’t recover from the crisis, 46% felt they weren’t in a strong enough financial position to handle challenges of the second wave, 41% feel in a worse financial position than at the beginning of the pandemic. (1)

In times of high stress and emotion, not surprisingly our ability to make sound decisions can be negatively impacted and this goes for how we spend and save.

At the one end of the budgeting spectrum, you may be thinking: “life is short, I’m going to spend what I can now”. Or you may fall into the “I don’t want to spend at all in case I lose my job or my investment income drops” category.

Of course, neither of these perspectives is optimal. The best approach is to acknowledge the emotion behind your thinking and make a plan that balances enjoying today with a comfortable future.

Strategy – Revisit your current goals and set new priorities

Has anything changed given the pandemic? Are you finding that your expenses have been reduced in some areas, gone up in others? If so, can you free up savings to allocate towards priority goals? Or have you had to readjust your budget to cover higher than expected expenses?

David and I still want to travel, hopefully locally this year, so we continue to save into our travel account, but we are also looking at finding surplus monies to top up our home improvements fund given we are currently spending less on other things.

2. Income Loss or Concern that Your Income Could Drop in the Future

Job security feels more fragile than ever before. Although the unemployment rate of 8.5% in November has improved from its low of 13.7% in May, it’s a far cry from the pre-pandemic rate of 5.5% in January 2020. (2)

And small business owners are being hit even harder. According to Statistics Canada, over half of businesses in Canada reported a revenue drop in the third quarter of 2020 compared to August 2019, irrespective of their employment size. Smaller businesses (less than 19 employees) reported a revenue decrease of 40% or more. (3)

While some of the financial impacts have been mitigated by government benefits and subsidies, you may still be dealing with significantly reduce cash flow. Even if your income hasn’t been affected, you may be worried that it could be hit later.

Strategy – Live within your means

If you’ve experienced or are worried about a reduction in your income, update your Spending Savings Plan to reflect the new numbers. You may need to reduce some of your expenses to avoid the need to go into debt. It’s better to temporarily give up some discretionary spending than to rack up credit cards or your line of credit especially in times of economic uncertainty.

Now, like no other time recently, is a reminder of how important an emergency fund is to help cover unexpected expenses or changes in income. Building our savings will also be a top priority for David and I in 2021.

Do the numbers. Use our Spending and Savings Plan worksheet to calculate and review your budget.

3. Debt Levels Have Dropped, Savings Have Increased

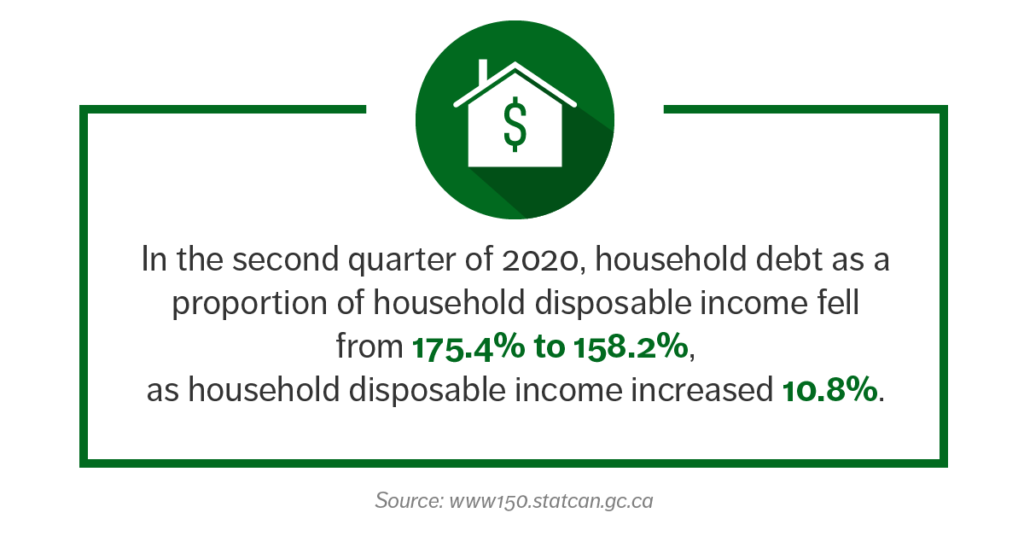

Fortunately, there is some good news! In the second quarter of 2020, household debt as a proportion of household disposable income fell from 175.4% to 158.2%, as household disposable income increased 10.8% and debt remained relatively unchanged. (4)

Also, a recent report from BMO Economics found the household savings rate hit a massive 27.5 per cent in the second quarter, compared with an average rate last year of just 1.4 per cent.

While it may be too soon to draw too many conclusions from these stats, it does suggest that the pandemic has altered some of our habits around debt and savings for the better.

Hopefully, some of these hard-won lessons will endure post-pandemic. In an article by John McCain, head of personal banking products and experience at Bank of Montreal, he advocates the concept of responsible spending as the key to emerging from the pandemic.

McCain describes responsible spending as thinking about how we act on a household, marketplace, and community level and the role each of us can play in restoring our economy.

Saving and using debt responsibly, supporting local businesses, and actively participating in philanthropy are ways we can ensure that as many Canadians as possible survive and thrive through the pandemic and beyond. (5)

Strategy: Spend responsibly

Take a look at how you are currently allocating your money using the responsible spending lens. How do you stack up? Are there any changes that you want to make to your 2021 budget?

4. More Time at Home

Like many professionals, David and I are now both working from home and have more time to notice all the household repairs and renovations that we didn’t have time to pay attention to before.

We aren’t spending as much on commuting, clothes, coffees and going out, so we have a pile to spend on home renos, right? Well, maybe.

It’s tempting to just dive in and book the contractor for the kitchen upgrade (if you can find one these days!), but it’s important to do the math. Savings from more at home time: $500/month x 12 months = $6,000. Small kitchen reno: $15-$20K. Hmm, this might take longer than we’d hoped, or some creative thinking will be needed!

Strategy: Do the math, make a plan

If your expenses have decreased and the savings are sitting in your bank account, go ahead and consider using the funds for home improvements. But, be careful about unplanned household upgrades that you can’t really afford. You don’t have to give up on the reno idea entirely, instead set up a savings account, name it “home improvements” and set up automatic monthly savings plan to accumulate the money you need. David and I will be in the saving and planning stage for the near future, but at least we have started to shift our priorities and work towards this goal.

5. Mental and Physical Health Implications

COVID-19 has had a mixed impact on our physical and mental health and has changed, possibly forever, how we approach and pay for health and wellness.

A New Year’s resolution survey by the Association for Canadian Studies found that over 55% of respondents said that COVID-19 had an impact on their new year’s resolutions and most of the top resolutions related to mental and physical health.

According to the survey, more than half of respondents said they are planning to be more active, improve their eating habits and lose weight next year and nearly half of respondents identified improving their mental health as a New Year’s resolution. (6)

More time outside and easier access to fitness classes and mental health support through online solutions are some of the positive outcomes of the pandemic that may also be time and money savers.

Strategy: Build wellness into your budget

With so many online courses and resources, it will be easier and more affordable in 2021 to stick to health and wellness resolutions. Make yourself a priority and add a line item in your budget for self-care and wellness if you don’t already have one. I love my online yoga and fitness classes! No travel required and no excuses to miss class.

How has COVID-19 affected your budget? We’d love to hear from you. If you are ready to better manage your money and plan for a bright future, we have a coach that can help.

So much happier…

“Thanks Sheila and team for providing sound financial advice. We are so much happier now that we have a monthly budget in place and a positive outlook for our future! The peace of mind this service has provided has reduced the conflict over our finances and was well worth the fees. We now feel much better about our plans to reach our goals. Sheila’s knowledge and advice was excellent and we will recommend her to our friends and family.” ~ Brad H.