By Karin Mizgala, Co-Founder and CEO of Money Coaches Canada

November is financial literacy month, and this year is its 10th anniversary. Interesting timing with COVID-19 raging in our midst and financial well-being feels more precarious than ever before.

There are some bright spots – many Canadians are spending less and saving more, interest rates are low, the stock market has been remarkably resilient, and there’s an opportunity to reflect and re-evaluate our goals and priorities.

As we navigate all the changes that we are experiencing, it is a good time to check in on our individual and collective financial well-being. What’s working, what isn’t?

One of the measures is our level of financial literacy. Stay with me while I review some of the key takeaways of some of the recent research.

What is it?

Financial literacy is defined as having the knowledge, skills, and confidence to make responsible financial decisions according to the Financial Consumer Agency of Canada (FCAC), the federal agency responsible for consumer protection and financial literacy. (1)

The state of Canadians’ financial literacy

Overall, Canada isn’t doing too badly, but there’s definitely room for improvement.

Canadians’ overall financial literacy was ranked third out of 29 countries in the OECD’s 2016 survey, which considered knowledge, attitudes, and behaviours. (2)

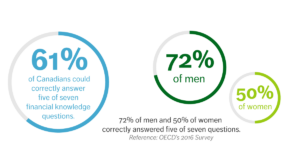

However, the same survey found that only 61% of Canadians — roughly the OECD average – could correctly answer five of seven financial knowledge questions. Men scored significantly better than women. (72% of men and 50% of women correctly answered five of seven questions).

Interestingly the knowledge gap between men and women in Canada was amongst the highest of the countries surveyed. (sheesh!)

The OECD survey also found positive correlations between financial knowledge and goal setting as well as between financial knowledge and retirement planning, suggesting that knowledge may reinforce positive behaviors.

Unfortunately, the 2019 Canadian Financial Capability Survey (3) showed that only 4 in 10 Canadians say they found ways to increase their financial knowledge, skills, and confidence in the past 5 years.

If you are a female entrepreneur and are curious about how to create a financial framework that helps you achieve your ideal life and business, our Money Map Coaching Program is right for you.

Recommendations from the surveys

Both surveys offered some excellent recommendations on how to improve financial literacy and financial well-being. Financial education in schools, targeted education based on specialized needs, making more tools available, especially budgeting, saving and planning calculators, and more regulation to protect consumers from fraud and scams.

It’s hard to argue with any of the recommendations, and there are some really excellent tools on the FCAC website.

However… yup here it comes.

The missing piece

When I started my career in financial planning, I was convinced that the worries and stresses around money could be alleviated by all of the great things that the studies above listed – tools, resources, education.

Sheila and I so passionately believed in the power of education that we create the Women’s Financial Learning Centre 15 years ago to address some of the knowledge gaps that are still (depressingly) prevalent today. We offered programs in countless formats – in-person classes, home study programs, teleseminars, webinars. We wrote two books. We’ve written hundreds of blog posts.

If you build it, they may not come… Even though we got rave reviews for all our programs, the uptake on financial education was never what we hoped.

What we’ve finally come to understand is that there are bigger hurdles that are harder to pinpoint. And these obstacles lead to a resistance to engaging with money that isn’t solved by traditional financial paradigms.

I recently asked a good friend of mine – a highly educated, professional woman in her early 60’s – what stopped her from wanting to get proactively involved with her money. She was recently divorced and had been agonizing over the financial decisions she is being faced with. And she has money, lots of it.

“First, I felt judged as being stupid. Second, I felt it was the domain of men, and I feared being taken advantage of. Third I felt it reflected my value as a person. If I had no money, I was ashamed. If I had lots of money, I am ashamed. It’s related to my fear of not feeling safe and not feeling I had a voice.”

While I’ve heard many variations of these types of sentiments, she’s not alone in identifying some of the deep fears, insecurities, and emotions that can get in the way of effectively and joyfully engaging with money.

Money and emotions

Guilt, shame, embarrassment, worry, fear of conflict with loved ones are common obstacles that can lead to avoidance of all things financial. Many of these emotions are suppressed and unconscious, so we avoid looking at money, learning about it, talking about it but tell ourselves that its because:

- I don’t like dealing with money

- I’m too busy

- My advisor/husband/daughter takes care of my money for me

- I don’t have enough money to plan

- I’m not good with money

Avoidance, however, eventually catches up, leading to a loss of control, bad decisions, unhappiness and cuts off the flow of resources to building a better world.

And the pandemic isn’t helping. A recent Canadian Payroll survey found 43 per cent of Canadians are financially stressed, and just 22 per cent consider themselves “comfortable.” The results had previously remained steady at about 33 per cent in each category since 2009. (4)

While good money management basics aren’t complicated, the psychological and emotional aspects of money can hijack our ability to take financial control.

How to break down the barriers to engaging positively with money

If you suffer from money stress or inertia or know someone who does, here are a few tips:

1. Be compassionate with yourself and curious about your relationship to money.

Begin by examining your beliefs and thoughts about money and reflect on your experience with money both past and present.

How did your parents handle money? Was it a source of stress in your family when you were growing up? Are you satisfied with the amount of money you have? Do you spend money to make yourself feel better? Do you put off making financial decisions and taking control?

Focus on what you’re doing well with money now and then consider areas where you would like to do better. Acknowledge all wins, no matter how small they are. Success begets success.

2. Break down the talking about money taboos.

Most of us don’t find money an easy thing to talk about in our culture. It’s rarely discussed openly in our families. We don’t tell our friends what we earn. We feel uncomfortable negotiating our salary, and we often avoid the topic with our partners for fear of rocking the boat.

But by keeping money in the shadows, it wields too much power over us and hurts our most important relationships.

Start a dialogue with your partner about your financial goals and values. This is a good place to start, especially if conversations about money have been tricky in the past.

Talk to your kids about money early – and often. You may not have learned about money when you were young, so this is your chance to break the cycle.

3. Find services and support that fit your values.

One of the biggest challenges my friend encountered post-divorce was finding an advisor she felt comfortable with. Most of her encounters with investment and financial professionals left her feeling frustrated, intimidated, disrespected, and stuck, which only reinforced her stress about money.

What she experienced was a financial power imbalance that adds yet another barrier to engaging proactively with money.

For Canadians to improve their financial literacy and engagement, the financial industry must do a better job at building trust and connection by addressing the complex emotions, fears, and insecurities that so many of us have about money. While financial advisors and banking professionals may love charts, graphs, numbers, and spreadsheets, many of their clients do not but are too intimidated to admit it.

I believe the onus is on the financial institutions to be more responsive to their clients. Still, you can begin to affect change for yourself and all Canadians by seeking out and supporting financial advisors and services that rate highly in terms of empathy, trust, and respect alongside their credentials and expertise.

Here are a few qualitative questions to consider when shopping for financial products and advice:

Here are a few qualitative questions to consider when shopping for financial products and advice:

- Does the product or service fit with your values?

- Is your advisor listening to you without judgment?

- How transparent are the fees?

- Do you feel respected?

- Are you comfortable asking questions?

While money may never be your favorite topic, taking one next positive step with your money is all that’s needed to put you on the path to improved financial literacy and well-being.

References

- https://www.canada.ca/en/financial-consumer-agency/programs/financial-literacy/financial-literacy-history.html

- http://www.oecd.org/daf/fin/financial-education/OECD-INFE-International-Survey-of-Adult-Financial-Literacy-Competencies.pdf#page=10

- https://www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html

- https://www.payroll.ca/PDF/News/2020/2020-NPW-Press-Release_EN.aspx

A little knowledge that acts is worth infinitely more than much knowledge that is idle. Kahlil Gibran

Are you ready for the next step? We have a coach that can help.