By Karin Mizgala, Co-Founder and CEO Money Coaches Canada

Meet Marisa and Anthony

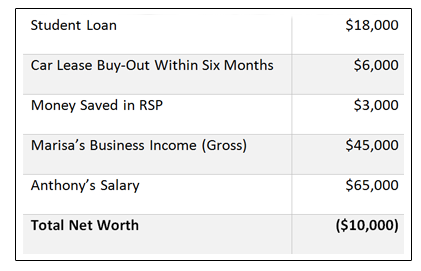

Marisa was a 35 year-old, self-employed, physiotherapist when we met. She and her husband, Anthony, a high school teacher, have two children, who were ages four and six at the time. The couple wanted to buy a house, but instead, they were living with Marisa’s parents, arguing about money— largely due to a bankruptcy that Marisa was going through. At times they wondered if their marriage would survive. Their story is real, but we’ve changed their names to protect their identity.

Money Challenge

Until her bankruptcy, Marisa believed that her financial life was hers alone to manage.

“I was raised to be a very independent woman,” she says. “I never even considered having a joint bank account with my husband.”

But without open communication, her husband was in the dark about her business struggles. When Marisa went bankrupt, Anthony lost trust in her, which just increased the stress and tension in their life. She knew that if she didn’t gain control of her money, her marriage would fail.

She needed to get clear about where her money was going. Her personal and business expenses were mixed-up together instead of in separate accounts. What she was clear on, was that she needed help.

“I am a helping professional,” she says, “I know the value of objective help. So it made sense to reach out to a professional.”

She wanted to make real change in her business, and in her marriage.

Financial Facts

Money Makeover

The first step was untangling Marisa’s business income and expenses from her personal finances, and becoming crystal clear on her financial numbers.

That meant setting up a business bank account where it would be easier to track her income and expenses. We estimated her taxes and set-up a savings account where she could put money aside each month. Come tax time, she would be prepared instead of panicked.

We created a regular, sustainable “salary,” that she would pay into her personal account every two weeks. In addition, Marisa set-up savings accounts for the irregular business expenses that would often catch her off-guard. By putting money aside for items like professional development, liability insurance and licensing, when payments came due she wouldn’t be scrambling to find the funds.

“Anthony and I had been together for quite a while,” says Marisa. “We’d been surviving our financial life together, however we were very separate in the way we managed our money. Coaching helped us to become a much more united front. We didn’t just talk about numbers. We got to the heart of the issues that were making me fail.”

“I needed to learn to talk about my money with my husband, and to rebuild his trust,’” she says. “I could run a business as a sole proprietor, but when it came to managing a family, I couldn’t do it well without good communication.”

“I needed to learn to talk about my money with my husband, and to rebuild his trust,’” she says. “I could run a business as a sole proprietor, but when it came to managing a family, I couldn’t do it well without good communication.”

Part of that communication was to define targets and time frames for the car lease buyout and home ownership.

It was important to Marisa and Anthony to keep some level of financial independence, but they began to see how crucial team work would be for financial success as a couple. To that end, they opened a joint chequing account to which they both contributed. That account was for the common expenses like groceries, and the needs of the children. The couple also opened a joint savings account to save for a home.

Results

Within four months of our working together, Marisa’s anxiety around money decreased substantially.

She says, “I had to get honest with myself and become conscious and mindful of how I was spending my money every day. Just like my physical health and my mental health, my financial health became part of my everyday habits.”

What made that possible was a concrete plan that she could actively implement. She had goals, and seeing progress helped her manage her stress.

What made that possible was a concrete plan that she could actively implement. She had goals, and seeing progress helped her manage her stress.

Anthony was impressed with the spreadsheets that we put together and his confidence in Marisa increased. He started to become more proactively involved in the planning process which he hadn’t done in the past. Their money conversations now ended with results instead of arguments.

The car lease was bought out on schedule and the monies redirected to the couple’s home ownership goal and to RESPs for their children.

10 Years later

Marisa and I have now worked together for 10 years. She and Anthony faithfully update and follow the system that we put in place 10 years ago.

We speak regularly to review and update her business and personal cash flow plan. They bought their home as planned in 2013 and are now mortgage free. Their net worth has increased from minus $10,000 to over $750,000, partly due to savings and party due to an inheritance. They have $300,000 in savings and are now starting to plan pro-actively for retirement. Marisa is working less but earning more and money is no longer a source of stress or worry. They are starting to travel more and are enjoying a balanced life.

“I enjoy the regular check-ins,” she says. “I could do this on my own now, but it helps me stay accountable.”

“I’m no longer burdened by money, I feel like an excellent money manager for my family and my business. Getting help saved my marriage. Anthony and I now understand that communicating about money is as important as communicating about everything else in our relationship. Money health turned around my entire life.”