Financial well-being comes with a deeper understanding of where you stand with money, emotionally and financially, developing concise and attainable goals, getting organized and implementing a manageable plan to move forward.

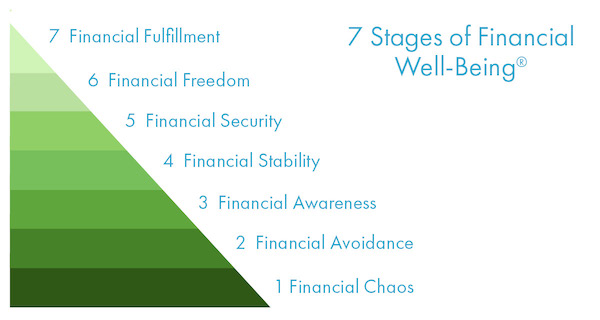

We created the 7 Stages of Financial Well-Being®, a framework Canadians can use to identify their feelings and behaviors towards money, assess their current situation, and focus on the right things to improve their financial well-being. This framework provides our clients with a clear and measurable way forward.

Financial well-being is very personal. It has less to do with an external measure of wealth, and more to do with knowing you and your family are succeeding within your vision of success.

Knowing where you stand on an objective framework like the 7 Stages of Financial Well-Being allows you to take stock and focus on next steps to meet your goals, regardless of income.

Let’s take a closer look at the 7 Stages of Financial Well-Being, and some of the potential emotions and behaviors associated with each stage. And don’t forget to take our quiz to see exactly where you stand.

1) Financial Chaos

In Financial Chaos, you’re having a very tough time financially despite earning a good income. Perhaps you were never taught about money or you’ve experienced a difficult life situation or health issue that has affected your finances.

- Emotions: Fear, guilt, shame

- Behaviours: Avoiding, abdicating, overspending, family conflicts

- Financial Status: No savings, taxes not done, bills unpaid, mail unopened, abdicating financial management to parent or spouse

2) Financial Avoidance

In Financial Avoidance, you recognize there are problems with your finances but are avoiding taking action. Despite being a well-paid professional, you feel worried, overwhelmed and stuck, and likely need the help of an expert to make sense of your situation.

- Emotions: Overwhelmed, confusion, insecurity, frustration

- Behaviours: Paralysis, not sure where to turn, head in the sand

- Financial Status: Random savings, no advisor, disorganized finances, accounts at various banks, little financial control/knowledge

3) Financial Awareness

In Financial Awareness, you are ready to take charge and start thinking more proactively about your finances and your future. It’s now time to start creating cash flow and debt management plans to move you closer to your goals.

- Emotions: Curiosity, trepidation, willingness

- Behaviours: Ready to take control and change habits

- Financial Status: Conscious of need for a plan, often prompted by debt or life event (job, divorce, retirement), ready to learn and take charge

4) Financial Stability

In Financial Stability, you have a lot of the basics in place and financial security is in your sights but you don’t have it all together. Now is the time to evaluate threats to your financial well-being and put crucial safeguards in place to ensure unexpected life events don’t blindside you.

- Emotions: Relief, sense of accomplishment, cautiously optimistic

- Behaviours: Looking for reassurance, seeking information, getting organized

- Financial Status: Have advisor or savings plan, debt under control, living within means, building assets (RSPs, home equity), good daily money management skills

5) Financial Security

In Financial Security, you have a plan and it appears to be working. You’ve made good decisions, prepared for the unexpected in life, and are moving towards achieving financial independence. It’s time to make sure that you are making the most of your money and taking advantage of available investment, estate and tax planning strategies.

- Emotions: Confidence, control, openness, concern or worry about future

- Behaviours: Planning for the future, considering life choices and assessing options

- Financial Status: Providing for the unexpected: estate plan, insurance up-to-date, kids’ education saved for, savings plan maximized, minimal & controlled debt

6) Financial Freedom

In Financial Freedom, you have enough money to live the life you want but may find yourself concerned that future events outside of your control (personal, economic or societal) may throw you a curve ball. Be sure to have regular check-ins with your financial planner or Money Coach so that you can ‘course correct’ as required.

- Emotions: Sense of achievement, what’s next, life purpose issues, fear of loss, do I really have enough

- Behaviours: Retirement, downsizing, volunteer work, living elsewhere, travel

- Financial Status: Achieved financial independence, focus on personal enjoyment

7) Financial Fulfillment

If you’ve achieved Financial Fulfillment, you are confident that you have enough and that money is no object. You spend and give money in alignment with your values and you never worry that your financial security is at risk even when life events intervene.

- Emotions: I have enough, generosity, peace of mind

- Behaviours: Charitable giving, setting up foundations, involved in humanitarian projects, giving back (time and money)

- Financial Status: Money is no object and a non-issue, “I have everything I need and more”, share knowledge, wealth allocation

We invite you to take the 7 Stages of Financial Well-Being quiz. The quiz will provide you with an understanding of where you are today and offer concrete action steps to improve your financial well-being.