By Noel D’Souza, P.Eng, CFP®

Introduction

Introduction

You’ve worked long and hard in Canada for years, quite possibly several decades, and now the finish line is in sight. Retirement. That Holy Grail.

Just one minor thing: How are you going to pay for it?

You may have a company-sponsored pension to support your income needs during retirement, or you may have had to sock a hefty chunk of money away in an RRSP, bit-by-bit over many years.

But if you’ve worked in Canada as an employee or self-employed person, you’re likely entitled to receive Canada Pension Plan (CPP) retirement benefits as well as Old Age Security (OAS). These government programs form a significant component of Canadians’ post-retirement income, so it makes sense to spend a bit of time understanding how they work and what to consider when deciding when to start taking them.

Canada Pension Plan (CPP)

For a little background, CPP is a contributory program where the contributor pays a percentage of their income into the plan, which is also matched by their employer. Self-employed folks get the “privilege” of paying both the “employer” and “employee” components.

These contributions are tracked throughout your work history, and the amount you will ultimately receive as a retirement benefit depends on the amount you contributed to the program.

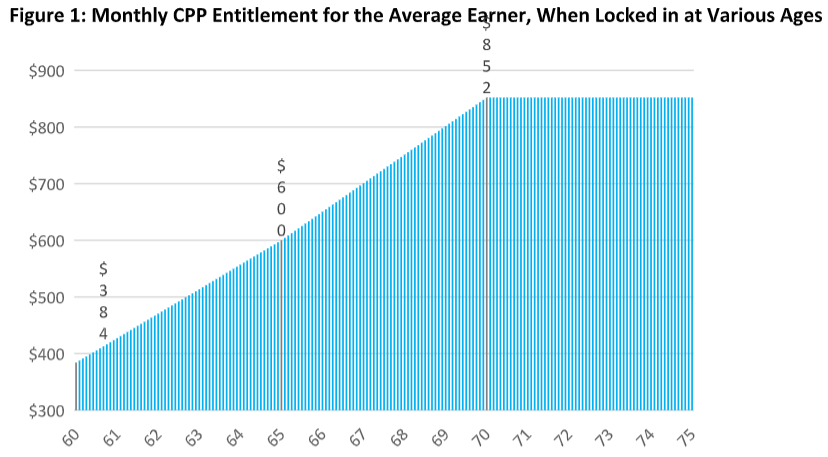

CPP can be taken as early as age 60, though age 65 is considered “Normal Retirement Age.” The maximum CPP retirement benefit for 2021 is $1,203.75/month, or $14,445/year at age 65, though the average Canadian receives about half that.

Here’s where things get interesting. For each month before your 65th birthday that you take CPP “early,” your benefit is reduced by 0.6%, with a maximum 36% reduction if taken at age 60. On the other hand, for each month you wait after your 65th, you gain 0.7% or a maximum 42% increase in benefits if you wait until age 70.

Figure 1 illustrates how this locked-in monthly entitlement grows between age 60 and 65, accelerates through age 70, and plateaus thereafter (based on 2021 figures).

Old Age Security (OAS)

With OAS, your benefit is tied to the number of years you’ve been a Canadian resident after age 18. If you have lived in Canada for at least 40 years (after age 18) you’re eligible for a full OAS pension, otherwise it will be prorated as long as you have lived in Canada for at least 10 years. Payments are available from age 65 but can be deferred until age 70 with a 0.6% increase per month of delay. However, if your net income exceeds $79,845 (for 2021), you will be required to repay 15 cents per dollar of your OAS due to the OAS pension recovery tax, commonly referred to as the OAS clawback. If your net income reaches $129,757, your OAS will have to be completely repaid.

Things to Consider When Deciding When to Take CPP and OAS

There are a few important factors to consider when deciding when to start receiving your CPP and OAS pensions.

1. When do you intend to (substantially) retire from work?

Although you can start receiving CPP and OAS pensions while still working full-time (as long as you otherwise qualify), most people don’t since payments would be added to their taxable income – on top of their regular salary – and very likely taxed at a significantly higher rate compared to payments received after retirement. In the case of OAS, you are more likely to be forced to repay your OAS pension due to the OAS recovery tax. On top of that, you’re locking in payments for life at a lower amount than what you would be entitled to by waiting.

For example, Marie is 65 and earns $100,000 per year in her job. She knows she is eligible to start receiving her CPP and OAS now, but enjoys her work and plans to work a few more years. Based on her CPP contribution history, she is entitled to receive $1000/month in CPP and a full OAS pension of $635.26. If she were to begin taking her CPP and OAS now, these amounts would be added to her income and taxed at over 40% based on her marginal tax rate. In addition, since her net income exceeds the OAS recovery threshold, she will also have to contend with a 15% OAS clawback. That hurts!

If instead Marie waits until she retires to begin her CPP and OAS pensions, depending on her other sources of retirement income she will likely be taxed at only 20%-30% and would not be subject to any OAS clawback. Both her OAS and CPP income will also get a boost due to the increase of 0.6% for OAS and 0.7% per month after age 65 that she waits.

You can also earn “post-retirement” (really, post “Normal Retirement Age”) CPP benefits by choosing to continue to pay into CPP while working after age 65, which will enhance your pension.

The bottom line is that it usually makes the most sense to start these pensions only after you have substantially stopped working and your taxable income from employment has dropped.

2. How much retirement income are you going to get from other sources while you wait for CPP and OAS to kick-in, and how much retirement income (in total) do you need to live the retirement you want?

Do you have enough coming in to “hold out” for larger CPP and OAS payments later?

You have to be able to pay your basic bills, and you undoubtedly want to enjoy a fulfilling retirement, one for which you have likely planned your entire life. If you have a set-in-stone retirement date in mind and really need CPP and OAS payments to meet your retirement expenses, then by all means take them sooner than later.

It’s important to recognize, however, that by taking payments earlier you are foregoing a significantly higher guaranteed, inflation-adjusted source of income for life. Is it possible to fund your early retirement years from another source of savings? Can you work a little longer? Are you able to trim expenses a bit? Trim “the fat” that is, not the good stuff!

If you are able to cover your retirement expenses prior to age 70 from other sources, generally it makes sense to do so and enjoy a significantly higher, stable, guaranteed-for-life, inflation-adjusted stream of income from CPP and OAS starting at (or closer to) age 70.

3. How is your health? What is your expected longevity?

If only we knew how long we would live, we could make the “right” call on when to start CPP and OAS payments every time. But without a reliable crystal ball, it’s useful to look at what the statistics say and play the odds.

The numbers say that if you’ve made it to 60, there’s a better than even chance that you’ll make it to 86. Therefore, almost by default most reasonably healthy people should plan to delay the start of CPP and OAS as long as is practical.

However, if you have a health condition that will likely shorten your lifespan significantly, you will want to start payments sooner than later.

As a very rough guide, aim to collect your CPP for at least 10-15 years.

For example, if you believe you’ll have average or better longevity and make it to your mid-eighties, you’ll likely be better off holding out until age 70. If on the other hand, you have strong reason to believe you’re unlikely to live past age 70-75, by all means start your CPP at age 60 and OAS at 65.

Conclusion

CPP and OAS are two of several possible sources of retirement income that you can rely on to last, well, as long as you do! When to start receiving them depends on several factors specific to your situation, including your desired age of retirement, other sources of retirement income, and health and expected longevity.

Work with your advisor to determine how these important government programs best fit into your comprehensive retirement income plan.

Note: This article was originally published as a resource for Leith Wheeler Investment Counsel Ltd. You can find this article and other articles of interest at: https://www2.leithwheeler.com/resources/newsletter

Can I elect to stop paying into CPP while still working past the age of 65? My contributions are likely larger than what I will recoup once I start taking my CPP.

Currently I am working part time and contributing $145 every 2 weeks. This is $3200 per year basesd on the weeks worked.

Thanks for your question Laila.

According to the Government of Canada “… your contributory periods end when you either start receiving your CPP retirement pension, turn 70 or die (whichever happens earliest).”

So if you are still working past the age of 65 (and before age 70), you will still be required to contribute to CPP *unless* you have started receiving your CPP retirement pension. In that case, contributions to CPP are optional and will add to your post-retirement benefit.

To what degree CPP contributions after age 65 will benefit an individual will vary based on the person’s contribution history and longevity.

I think that how CPP is calculated (ie the number of drop off years during employment ) should have been discussed in this article. As an early retiree this will make a huge difference to when I take CPP as it could to other early retirees.

Thanks for your comment Amy.

The CPP Dropout Provisions can affect the benefits one receives from a CPP retirement pension, though the impact will vary depending on one’s personal CPP contribution history and the provisions that apply.

However, when looking at one’s CPP retirement pension and deciding when to begin payments between age 60 and 65, in general the negative effect of one additional year of low or no income in a long contributory period is relatively small when compared to the effect of starting CPP payments one year earlier and incurring a reduction in payments of 7.2% (0.6%/month x 12 months).

Still, the Dropout Provisions are worth considering when deciding “When should I retire?”, a slightly different though related question. The dropout rules are complex, and it’s best to work through the details of your situation to consider and balance all the competing factors to come up with the best answer for your situation.

I am currently working full time. I have decided to not take CPP or OAS for now. Should I take the money and re-invest in a RRSP with the potential of making more money for myself or should I just wait till I need the money when I retire?

Thanks for your question Brad.

You have noted a very important point: by following this strategy, one is trading higher future guaranteed, inflation-adjusted retirement benefit payments for lower current payments with the *potential* of making more money by investing the amount received. Of course that implies there is also the potential for ending up with less money!

Consider that the time between the earliest one can take CPP (age 60) and the latest (age 70) is 10 years, or 5 years in the case of OAS (age 65 and 70 respectively).

When we think about experiencing the benefits of compound growth in our investments, 5 or even 10 years is not a lot of time to make up the massive 2.2x difference (in the case of CPP) in monthly payments. And once those lower payments start, there’s no going back.

A shorter investing time horizon also makes one more susceptible to the risks of short-term market fluctuations in the type of investments that typically provide higher long-term returns.

Having said the above, whether or not this strategy is appropriate for you, Brad, will depend on many factors that are specific to your situation. It sounds like you are close to retirement, and I would recommend working with a qualified advice-only financial planner to dig into the details so you can make an informed decision.