Tom Bradley, President and co-founder of Steadyhand Investment Management Ltd.

Money Coach Noel D’Souza, P.Eng.,CFP® recently sat down with Tom Bradley, President and co-founder of Steadyhand Investment Management Ltd. to talk about what Steadyhand offers Canadian investors how it serves its clients and his perspective on personal finance in Canada.

In addition to Tom Bradley’s leadership at Steadyhand, he selects and monitors Steadyhand fund managers and manages the firm’s Founders Fund. He has over 30 years of experience in the investment industry, including senior leadership roles at other well-known investment management firms. He currently serves as the Chairperson of the Investment Committee of the Vancouver Foundation.

Noel: Tom, who would you say is Steadyhand’s typical client and what services does Steadyhand offer?

Tom: We have a wide variety of clients, but I’d have to say that the bulk of our clients are what we call midlife professionals, in their forties and fifties, busy with kids and careers and the stuff of life. Very smart people who just don’t have the time, interest, or maybe knowledge, on the investment side of their finances, and so they look to us to do that for them.

We also have an increasing number of young clients. Our low minimums, which are ten thousand per fund, have opened that door. But of course we also have many retired clients as well.

We also have an increasing number of young clients. Our low minimums, which are ten thousand per fund, have opened that door. But of course we also have many retired clients as well.

Our average client portfolio is around $275 000, but we have many clients under $100,000. We offer them investment management and we offer investment advice, not holistic financial planning.

Noel: I think that’s one of the reasons why Steadyhand’s work resonates with what we do at Money Coaches Canada, and why we work well together; we also typically serve busy mid-to-late career professionals, but we provide that holistic financial planning element.

What would you say is the single greatest benefit that a client will experience when working with Steadyhand?

Tom: I’d say that the single greatest thing we do for our clients is right in our name; we do a very good job of providing a steady hand. Dealing with the ups and downs of the market is crucial to long term returns. We keep people on track. We’ve looked at the data and our clients are letting the power of compounding, which Einstein calls the eighth wonder of the world, work for them in growing their assets over time.

We’re all living longer. We want people to think ahead to what I call the last third of their lives, which is going to start somewhere in their sixties and could very well go into their nineties. We need to get people to think ahead to that last third. Continue reading →

Where did you learn about money? From school, from your parents, from a life of hard knocks?!

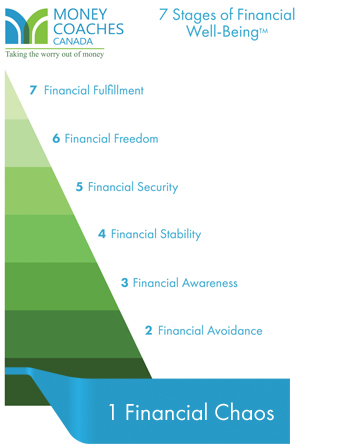

Where did you learn about money? From school, from your parents, from a life of hard knocks?! The base of the

The base of the

We also have an increasing number of young clients. Our low minimums, which are ten thousand per fund, have opened that door. But of course we also have many retired clients as well.

We also have an increasing number of young clients. Our low minimums, which are ten thousand per fund, have opened that door. But of course we also have many retired clients as well.