Bruce Sellery of Moolala recently spoke with our own Karin Mizgala, co-founder of Money Coaches Canada, about the On Your Side Investment Report Card™ service and why Canadians should get a second opinion on their investment portfolio.

Bruce Sellery of Moolala recently spoke with our own Karin Mizgala, co-founder of Money Coaches Canada, about the On Your Side Investment Report Card™ service and why Canadians should get a second opinion on their investment portfolio.

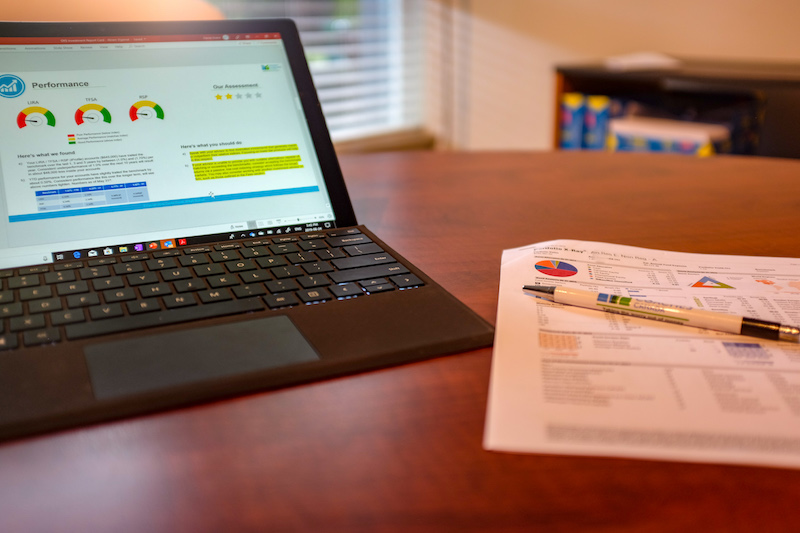

The On Your Side Investment Report Card provides answers to some of the most important questions investors have about their portfolio, including:

- How do I get started with building an investment portfolio?

- Is my investment portfolio performing as well as it should?

- Do I have the right investment strategy for my goals and needs?

- Am I paying too much in investment fees?

- What should I do to get my investments on track?

The answer to these questions – and many more – is an unbiased and independent second opinion. That’s why we created the On Your Side Investment Report Card.

Please click on the recording below to listen to the Moolala Money Made Simple podcast about the Investment Report Card. (running time approximately 11 minutes).

Learn more about the On Your Side Investment Report Card.

How is your money impacting the world? How is it impacting you?

How is your money impacting the world? How is it impacting you?

You know that a sound investment strategy is crucial to financial success, and you’re willing to pay an advisor for their advice and expertise. But how much should you pay? And how do you know if they are doing a good job or if your portfolio is performing as well as it should be? Investing is complicated, leaving most Canadians unsure of what questions to ask and equally unsure whether they would understand the answers.

You know that a sound investment strategy is crucial to financial success, and you’re willing to pay an advisor for their advice and expertise. But how much should you pay? And how do you know if they are doing a good job or if your portfolio is performing as well as it should be? Investing is complicated, leaving most Canadians unsure of what questions to ask and equally unsure whether they would understand the answers.