By Karin Mizgala, co-founder and CEO Money Coaches Canada

November is designated as Financial Literacy Month in Canada. Each year since 2011, the Financial Consumer Agency of Canada (FCAC), coordinates efforts between the private, public and non-profit sectors to promote financial literacy for all Canadians. This year’s theme: Managing money and debt wisely: It pays to know! is intended to highlight the importance of living within your means, knowing your financial rights and responsibilities and having a spending and savings plan that adapts to the different stages of your life.

November is designated as Financial Literacy Month in Canada. Each year since 2011, the Financial Consumer Agency of Canada (FCAC), coordinates efforts between the private, public and non-profit sectors to promote financial literacy for all Canadians. This year’s theme: Managing money and debt wisely: It pays to know! is intended to highlight the importance of living within your means, knowing your financial rights and responsibilities and having a spending and savings plan that adapts to the different stages of your life.

At Money Coaches Canada, financial literacy and empowerment have always been part of our core values. Our financial coaching approach facilitates what Canadians want; to spend smarter, manage better and to have a proactive and adaptable plan for their financial future.

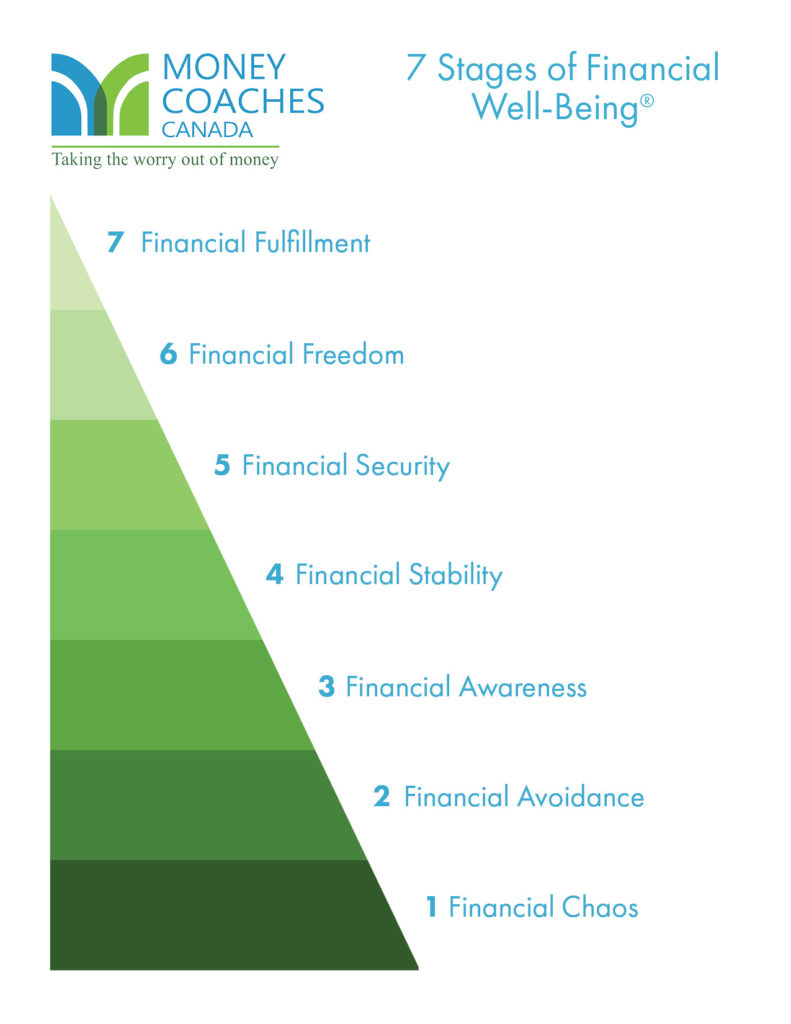

Clarity on your current financial situation is vital to developing concise, attainable goals. With that in mind, we created the 7 Stages of Financial Well-Being®, a framework Canadians can use to identify their current feelings and behaviours around money, and to provide them with a clear and measurable way forward. We invite you to take the 7 Stages of Financial Well-Being quiz to assess your current situation. The quiz will provide you with an understanding of where you are today and offer concrete action steps to improve your financial well-being.

The 7 Stages of Financial Well-Being model helps clients focus on the right things at the right time, which is why it is at the centre of our coaching relationships. When you work with a Money Coach you’ll begin by defining success on your terms; then move from clarity to action, all with an ally for accountability and guidance.

The 7 Stages of Financial Well-Being model helps clients focus on the right things at the right time, which is why it is at the centre of our coaching relationships. When you work with a Money Coach you’ll begin by defining success on your terms; then move from clarity to action, all with an ally for accountability and guidance.

7 Stages of Financial Well-Being ®

Let’s take a closer look at each stage on the graphic and the emotions, behaviours and financial status associated with each one.

1. Financial Chaos

- Emotions: Fear, guilt, shame

- Behaviours: Avoiding, abdicating, overspending, family conflicts

- Financial Status: No savings, taxes not done, bills unpaid, mail unopened, abdicating to parent or spouse

2. Financial Avoidance

- Emotions: Overwhelm, confusion, insecurity, frustration

- Behaviours: Paralysis, not sure where to turn, head in the sand

- Financial Status: Random savings, no advisor, disorganized finances, accounts at various banks, little financial control/knowledge

3. Financial Awareness

- Emotions: Curiosity, trepidation, willingness

- Behaviours: Ready to take control and change habits

- Financial Status: Conscious of need for a plan, often prompted by debt or life event (job, divorce, retirement), ready to learn and take charge

4. Financial Stability

- Emotions: Relief, sense of accomplishment, cautiously optimistic

- Behaviours: Looking for reassurance, seeking information, getting organized

- Financial Status: Have advisor or savings plan, debt in control, living within means, building assets (RSP’s, home), good money management skills

5. Financial Security

- Emotions: Confidence, control, openness, concern or worry about future

- Behaviours: Planning for the future, considering life choices and assessing options

- Financial Status: Providing for unexpecteds: estate plan, insurance up-to-date, kids’ education saved for, savings plan maximized, minimal & controlled debt

6. Financial Freedom

- Emotions: Sense of achievement, what’s next, life purpose issues, fear of loss, do I really have enough

- Behaviours: Retirement, downsizing, volunteer work, living elsewhere, travel

- Financial Status: Achieved financial independence, focus on personal enjoyment

7. Financial Fulfillment

- Emotions: I have enough, generosity, peace of mind

- Behaviours: Charitable giving, setting up foundations, involved in humanitarian projects, giving back (time and money)

- Financial Status: Money is no object and a non-issue, “I have everything I need and more”, share knowledge, wealth allocation

There is no value in comparing your financial situation to that of your friends, neighbours or colleagues. Financial well-being is very personal and has less to do with an external measure of wealth, and more to do with knowing you and your family are financially secure, within your vision of success, now and in the future. But there is great value in knowing where you stand on an objective framework like the 7 Stages of Financial Well-Being because it allows you to take stock, and focus on next steps to meet your goals regardless of income. A high earner can be in Financial Chaos and someone with a more moderate income can have reached Financial Stability.

because it allows you to take stock, and focus on next steps to meet your goals regardless of income. A high earner can be in Financial Chaos and someone with a more moderate income can have reached Financial Stability.

As part of financial literacy month, we encourage you to take our straightforward 7 Stages of Financial Well-Being quiz to assess your current situation.

If you feel overwhelmed or want support along the way, a Money Coach can help you create a plan to reach your goals. We offer unbiased professional advice to stay focused and on-track for the long run. From debt and cash flow management, through to retirement strategies, investment analysis, tax and estate planning, a Money Coach has the skills and experience to meet your needs.

Awesome post and very informative!