Director, Communications

“You cannot escape the responsibility of tomorrow by evading it today.”

― Abraham Lincoln

We live busy lives. We’re pulled in so many different directions, sometimes it’s a wonder how we manage to get anything done.

We live busy lives. We’re pulled in so many different directions, sometimes it’s a wonder how we manage to get anything done.

Thankfully, we humans are highly efficient, rational beings. We prioritize our important goals and diligently and consistently allocate our precious time to focus on only the most important activities to achieve those goals.

Right.

In truth, we know there are things we should have taken care of a long time ago, important tasks or projects that REALLY need to get done, yet somehow, they still sit on our mental To-Do list. And those are just the things we know we need to do… there’s probably a list of things we need to tackle that we aren’t yet aware of.

Instead, we spend our days focused on what seems to be urgent, rather than what’s truly important.

When it comes to our finances, the pull of the urgent is all too familiar. Managing endless bills, paying off debt, dealing with unexpected expenses, filing our taxes… there are a host of time sensitive activities that scream for our attention.

But what about those things that aren’t urgent, but are vitally important for our financial well-being?

Things like putting life or disability insurance in place, so that your family isn’t financially devastated if something were to happen to you.

Well, that can wait… I’m pretty careful, I’m not planning on dying or getting injured anytime soon…

Perhaps making (or updating) your Will and Powers of Attorney, so that your affairs can be administered smoothly when you can’t manage them yourself.

But I’m pretty young and in good health. I won’t have to deal with mental or physical decline or death for decades, so no rush there…

How about saving for retirement in 20 or 30 years?

Well… that’s 20 or 30 YEARS away! Plenty of time! I’ve got too much going on NOW, and besides I love my job and don’t see myself retiring.

I think you see where this is going. Things are fine, until they aren’t. There’s lots of time to take care of the To-Do list, until there isn’t.

As advice-only financial planners and Money Coaches, we see these situations with our clients all the time.

So why focus on important financial matters, and not just the urgent ones?

1. Neglecting important financial matters can lead to financial hardship and regret

When we neglect important financial matters, we’re paving the path to greater financial hardship in the future. We can turn small financial issues into big ones or find it’s too late to protect ourselves against unlikely but potentially catastrophic risks. On our 7 Stages of Financial Well-Being, you’ll find the first three stages typically involve some level of neglect of important financial matters.

2. Urgent financial matters can distract us from what’s truly important

It’s easy to get caught up in the urgency of day-to-day financial tasks and lose sight of our long-term financial goals and priorities. By prioritizing important financial matters, we can avoid getting sidetracked by the urgent and focus on what truly matters for our financial well-being.

3. Prioritizing important financial matters leads to long-term financial stability

On the flip side, by dedicating time and effort to important financial matters, we can make progress towards our financial goals, such as paying off debt, building an emergency fund, saving for retirement, and investing. Here’s where clients graduate to the middle stages (Financial Stability and Financial Security) in their lifelong journey.

4. Prioritizing important financial matters leads to better financial decision-making and gives us more options

When we prioritize what’s important, we’re able to make better financial decisions, which leads to better outcomes and increased financial well-being. With greater financial well-being, our options for the future really open up, not to mention the amazing peace of mind it brings. Looking to reach the highest stages of Financial Well-Being? This is the way.

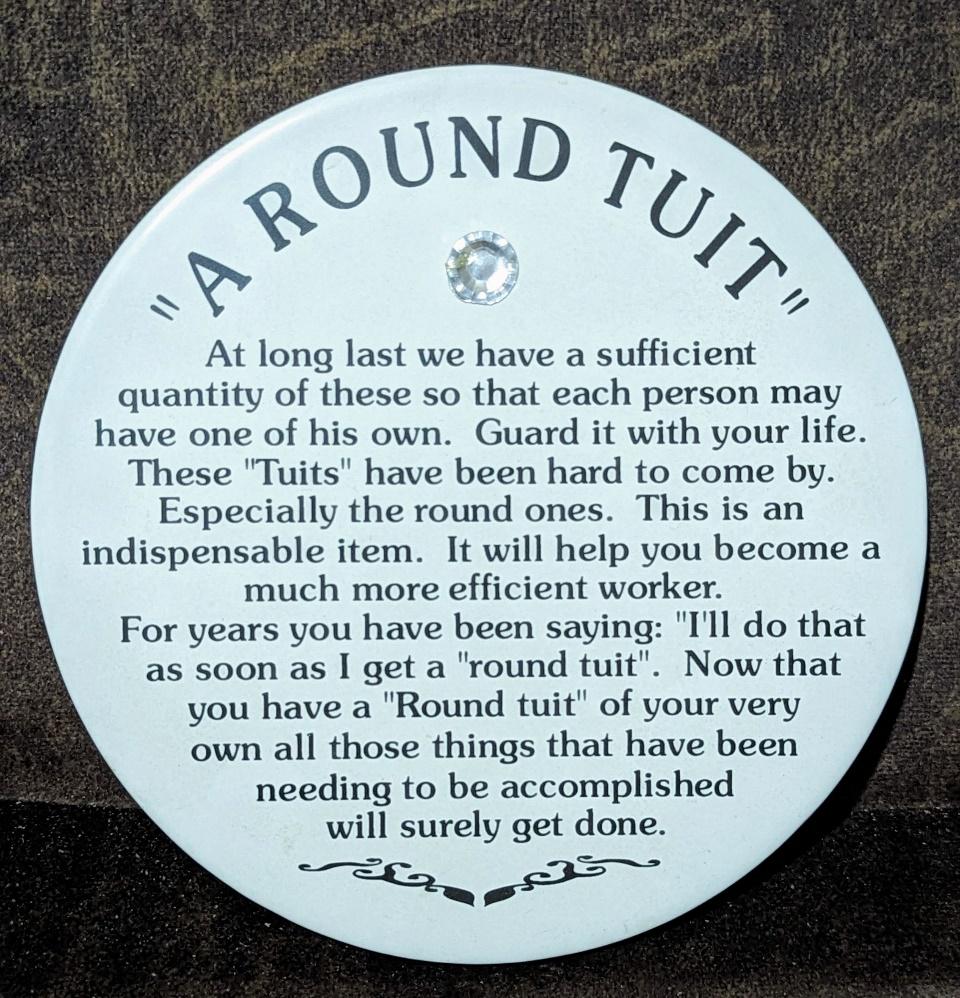

Making the transition from managing urgent issues to planning for important ones can be challenging. Fortunately, helping our clients tackle their financial To-Do list is precisely what we do, not only in terms of highlighting the neglected items and bringing them to the forefront, but working closely with our clients to help and motivate them to take action so we can steadily chip away at that “Important, but not Urgent” list.

Getting around to it someday just isn’t good enough. Contact us today for a complimentary consultation.