By Karin Mizgala, Co-Founder and CEO Money Coaches Canada

Canadians have a reputation for being polite. Maybe that’s why for years we’ve put up with investment fees that were confusing, often hidden, and higher than necessary.

Canadians have a reputation for being polite. Maybe that’s why for years we’ve put up with investment fees that were confusing, often hidden, and higher than necessary.

But polite doesn’t necessarily mean passive. Over the past several years, Canadians have demanded more transparency from their financial advisors and financial institutions. And thanks to changes implemented by the Canadian Securities Administrators (CSA) over two years ago, we now have access to more information.

But do you feel better informed?

I meet many people who still wonder if the investment fees they pay are too high, and who question the value of the financial advice they receive but aren’t sure what to do about it or where to turn.

First let’s recap what the CSA has put in place, and then examine how fees impact your finances.

How the CSA Created Greater Transparency

When phase 2 of the CSA’s Client Relationship Model, known as CRM2 went into effect in 2015 and 2016, Canadian investors began to receive two reports each year. The first report itemizes the advisory fees and commissions paid by the investor, and the second has information on how well their investments have performed.

That first report, The Report on Charges and Other Compensation, was quite an eye opener for many investors. And it doesn’t even include the mutual fund MERs paid as management fees, which are not required to be reported under CRM2.

Fees are not intrinsically bad—there will always be costs involved with investment services and transactions. What’s important is value for those fees. And even more importantly, understanding how fees impact your financial future. (Click to Tweet!)

The Damaging Effect of Fees on Portfolio Performance

For anyone overwhelmed—or a bit intimidated—by investment options, it can be easy to dismiss fees as inevitable, and therefore not worth worrying about. It can seem more important to think about diversification and risk assessment. But in reality, the fees you pay on your investments are as important to your long-term investing success as movement in the stock market. Investors should not ignore the impact of fees.

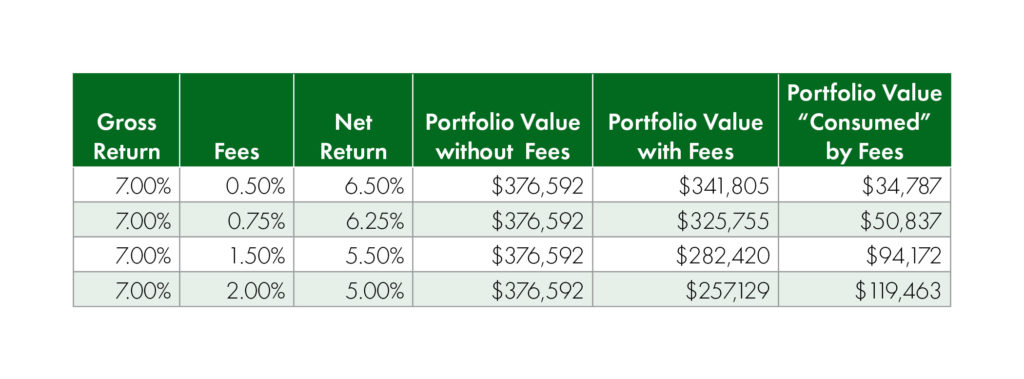

Here is an example of what I mean. Imagine you contribute to your investments over a 30-year career. You start with an initial investment of $3,000. You invest an additional $3,500 per year until year 30.

Let’s assume a 7% annualized gross return. Sounds good, but your net return over the 30 years will be reduced by the fees that you paid. It could be significant.

In the chart below, the only variable is the fees. I think you’ll agree that the impact is worth paying attention to. Shouldn’t you ensure you aren’t paying more than necessary?

Don’t Fear Fees—Understand Them

Whether you are new to investing or already have a portfolio, it’s important to take the initiative to understand fees. There is no way around them. Even if you decide to manage your own investments, you will still end up paying fees, albeit typically lower than for a managed portfolio.

If you are working with a financial advisor, ask questions and don’t tolerate an advisor who tries to baffle you with jargon. You shouldn’t have to go home and Google what they told you to gain clarity.

It’s also important to understand how a financial advisor is paid. It may seem like a deal to use an advisor who is paid by an investment company, but be sure that—‘free’—advice is actually free of bias.

It’s important that you understand it’s not uncommon for a financial advisor to receive a higher commission for recommending a specific type of investment. You need to be confident that your interests are all that’s being considered when investment decisions are made.

Here is a brief overview of possible fees.

- Expense Ratio: The expense ratio is the cost of building and operating the mutual fund. A fund with an expense ratio of 1.5% will cost you $15 a year on every $1,000 you have invested. It will be taken as a deduction from your gross return on investment.

- Front-End Load: It addition to the expense ratio on a mutual fund, an “A Share” fund has a commission that comes right off the top, or, as the name suggests, on the front end. For example, if the commission is .50 cents a share, shares purchased at $15.00 drop in value to $14.50.

- Back-end Load or Surrender Charge: Like the front-end load, a back-end load is in addition to the mutual fund’s operating expenses. And as its name suggests, it comes off your investment when you sell it. It’s not uncommon for this percentage-based fee to get lower the longer you have the investment. Meaning, it may be 5% if you were to sell in the first year of the investment and go down to 4% or 3% or lower, depending on how long you stay invested.

- Investment Management Fees or Investment Advisory Fees: This fee is usually deducted from your investment account quarterly, to pay your advisor for managing your investments. The fee is calculated as a percentage of the money you have invested. An investment of $100,000 with a 1% management fee equals $1000 per year in fees ($250 per quarter). Fees tend to be higher on investment accounts that are smaller, up to as much as 1.75%. The more money you have in your investment account, the more leverage you have to negotiate lower management fees. Whatever your fees, make sure you are getting value for your dollar with services like tax and estate planning.

- Transaction Fee: When you buy or sell with a brokerage firm you will pay a fee for each transaction. These fees range from $10 on the low side and over $50 on the upper end. These fees can add up quickly, especially on smaller transactions. Fifty dollars is only .10% of a $50,000 transaction, but it’s 1% if you are only investing $5000. A significant difference.

- Annual Account Fee or Custodian Fee: It’s not uncommon to pay a $25 – $90 fee on brokerage accounts and mutual fund accounts.

Focus on What You Can Control

There are some aspects of your financial future that you can’t control, such as tax rates, rate of return on your investments and the effects of inflation on your financial growth. But there are things you can control; your spending and savings habits and investment fees.

If you are struggling to save, or burdened by debt, ask for help from a trusted financial advisor or Money Coach. And when it comes to investing, understand what you are paying for, assess the value you are receiving, and decide if it’s time to get a second opinion.