How We Age is Changing

How We Age is Changing

As youngsters, we can’t wait to get older. Sometime later, we become less enthusiastic about our next birthday. We come to realize our mortality with the tick-tock of age. It’s a matter of perspective.

Age has also changed in perspective over history. For much of human history, the toil of daily work didn’t stop until health failed or death. Retirement didn’t exist. Caring for the elderly was short-lived if at all. When Benjamin Franklin uttered his famous quote: “Nothing can be certain, except, death and taxes”, the average longevity was just 35 with almost nobody reaching age 60. It would be the 20th century before average longevity creeped up to 50. With modern breakthroughs in health care and eradication of diseases, average longevity has surged to 85 today with many reaching 100. Aging isn’t gone but we have the opportunity to stay with it longer.

The idea of retirement is a much shorter story. A post-employment life didn’t emerge until the late 1800’s and a lengthy retirement has been prevalent for only the past 60 years. We have been re-calibrating age with retirement from generation to generation. Today, an average retirement period stretches 20 years. Tomorrow, it’s likely to be longer.

The reality is, we have more healthy and productive years available during and after employment. For most of us, the transition from employment to retirement is a big deal as a lifestyle change and a savings goal.

Emotionally, we fall somewhere between confident and dread depending on how prepared we are.

Emotionally, we fall somewhere between confident and dread depending on how prepared we are.

Financial mishaps such as business failure, employment loss, health conditions or excessive consumer spending can be a setback. More confidence can be derived from being flexible about your lifestyle expectations. Retirement does not have to be a one-time transition out of employment. We can choose to switch careers more readily, choose part-time or self-employment, ease in and out of leisure time, ditch employment early, or continue employment well into our 80’s.

Another factor is the natural shift in our values as we age. We tend to be pre-occupied with earning income, career advancement and child rearing earlier on and then shift more towards family, community and leisure. Forward looking plans are the ones that match closely to your personal life journey and account for the gradual shift in your personal values.

There is a general consensus that 65 is the proper age to retire. This comes from age 65 being set as the retirement norm since the Canada Pension Plan was introduced in 1965. We can be easily fixated on this society norm. It’s entirely your own choice to end employment at age 65, or sometime before or sometime after.

There is a general consensus that 65 is the proper age to retire. This comes from age 65 being set as the retirement norm since the Canada Pension Plan was introduced in 1965. We can be easily fixated on this society norm. It’s entirely your own choice to end employment at age 65, or sometime before or sometime after.

The trigger to start thinking about your own path to employment freedom is usually sparked by some life event. It can be as innocuous as needing reading glasses or a more shocking event such as a family member in failing health. At some point we realize life is fleeting and we had better make the most of it.

You may be surprised by which professions tend to stay with their careers longer. According to the Royal  Commission of Health Services, farmers are most likely to work beyond age 65 followed by sales occupations, family physicians and judges among others. These occupations typically have strong remuneration. What’s going on? They could all be poor at managing their finances but it’s more likely that career, community and personal values remain in harmony; particularly in these professions.

Commission of Health Services, farmers are most likely to work beyond age 65 followed by sales occupations, family physicians and judges among others. These occupations typically have strong remuneration. What’s going on? They could all be poor at managing their finances but it’s more likely that career, community and personal values remain in harmony; particularly in these professions.

On the other hand, there are people striving for super early employment freedom. The formula involves a high savings pace during employment, no children, and low lifestyle cost strategies.

Personal health is a key enabler whether you want to lengthen a productive career or live a long fruitful leisure lifestyle.

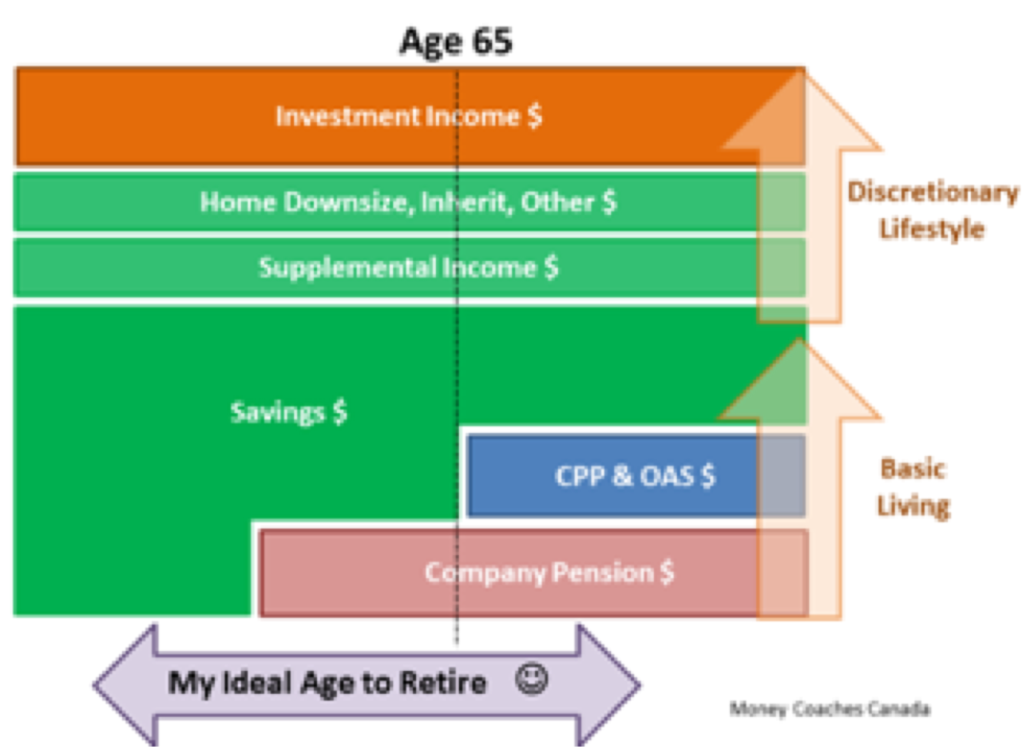

“The question isn’t at what age I want to retire, it’s at what income” – George Foreman. Sage advice from George. Work out what income you want to maintain during retirement. Determine how that income is to be created.

This chart illustrates the choices you make to determine your ideal age to retire. The layers of income add up to full retirement and you have flexibility around the lifestyle desired.

The 3 Pillars of Financial Freedom

- Government & Employer Pension Entitlements

- Canada Pension Plan (CPP) is designed to accommodate 25% of your lifetime retirement income. It varies based on # of years worked in Canada and the amount of your contributions to CPP while employed

- Old Age Security is a lifetime income entitlement based on your number of years as a Canadian resident

- Depending on your career and employer, you may also be entitled to a company pension for additional lifetime income

- Eliminate Debt

- No consumer debt including car loans

- Pay off your mortgage

- Live within your means

- Savings

- Supplements your pension income

- Assets are used as a source of a steady income

- Flexibility to increase / decrease flow of income

- Savings target is determined by how much is needed to furnish your income goal

Aging can be thought of as a burden or be embraced as an indicator of progress and a signpost to motivate action. Here are some tips:

- Recognize and embrace the aging process and your mortality

- Get real about what success and happiness means to you (physically, mentally, socially, spiritually). Money is a tool to get you there.

- Imagine your life outlook in stages. Career is simply one of these stages that eventually transitions out.

- Watch out for the mental auto-pilot. Whether we consciously or sub-consciously anticipate the end of our career, we may start to slow our mental growth such as less reading, and less learning. “I keep going because if you stop, you stop. Why retire? Inspire.” – Mickey Rooney

- Practice being retired well before you get there.

- Match your financial targets to your life goals

- Give yourself permission to stop accumulating wealth when your financial target is eclipsed

- Recognize that lack of hobbies, lack of activity or general lack of purpose is a faulty retirement expectation. Retirement needs to be a new busy time. The human mind and body wants constant stimulation to fire endorphins, feel good and feel strong. Stimulation = happy. Lack of plans = boredom.

Strategies to help you reach employment freedom sooner

Besides the more common strategies like getting a higher paying job or saving more, consider these effective options:

- Be specific about your lifestyle expectations as it may not be as costly as you imagine

- Obtain good estimates of your pension income entitlements

- Consider an eventual transition to part-time or choose a more flexible career

- Downsize your home

- Move to a lower cost community after employment no longer ties you down

- Co-habitate with other retirees

- Be industrious while retired to supplement income

- Offer a bed and breakfast service

- Offer vacation stays during high season or while you are away

- Spend winter in a warmer climate in a lower cost country

Embrace aging and use it as a motivator to take control and love your future.

Tom Feigs is a Certified Financial Planner and Associate with Money Coaches Canada. He provides financial planning guidance to consumers in the Calgary area and to many smaller communities throughout Western Canada. Tom takes pride in an unbiased advice approach and no conflict of interest as he does not sell financial products. His expertise covers cash flow, education savings, financial risk, retirement outlook, estate organization, and personal/small business investing balance.

“The article first appeared in the Spring 2019 edition of Canadian Society of Nutrition Management News.”