Director, Communications

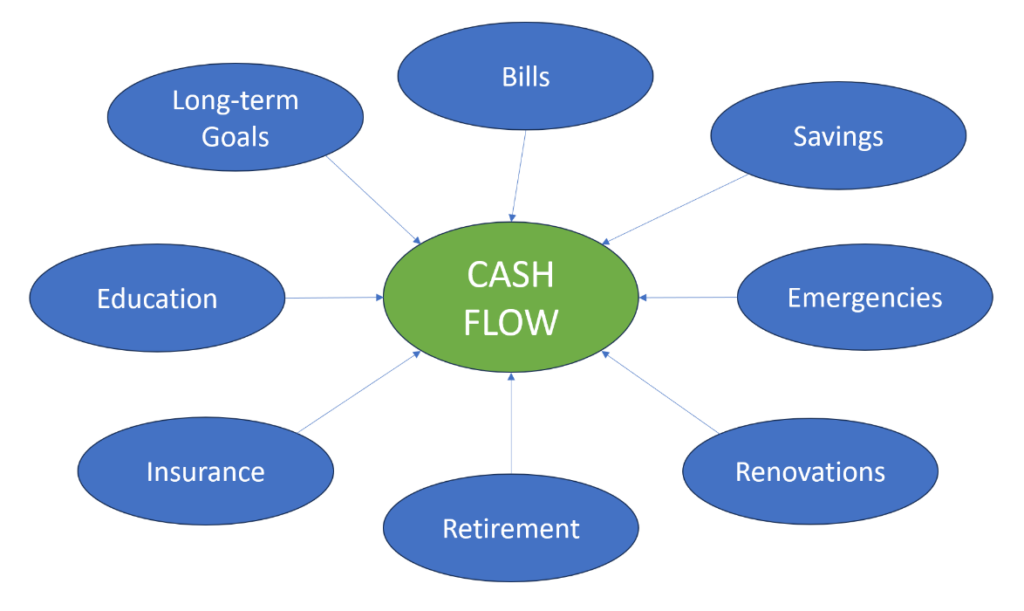

It has often been said that “Cash is King”, but when it comes to personal finance it wouldn’t be a stretch to say that it’s all about CASH FLOW.

Cash flow planning is a key aspect of financial planning that involves monitoring, analyzing, and managing the inflows and outflows of cash over a specific period. Effective cash flow planning is crucial for achieving financial stability, regardless of your age or income. It will help you manage your day-to-day finances, achieve your longer-term financial goals, and live a comfortable life free from money-related stress.

Let’s take a look at how cash flow planning plays a key role at various stages of life:

Early Adulthood

For a young adult just starting out on their own, cash flow planning will help establish a solid financial foundation and good money management habits. You create a cash flow plan, monitor your income and expenses, and manage and reduce your debt consistently.

Cash flow planning will also help you prioritize your financial goals, such as building an emergency fund, saving for a down payment on a home, or investing in your education or career.

You also need to consider disability and life insurance, which at their core are meant to ensure continued stable cash flow for you or your survivors if you are no longer able to generate cash flow to pay your bills by working.

Take Rachel, a new associate at a law firm. She’s managed to land an excellent job with long-term career potential, but life is BUSY! Despite a good income, money is tight. Rachel needs to figure out how much she can reasonably afford to spend on rent, ensure her income is protected if she can’t work due to illness or injury, invest in her career growth, and plan for personal goals which include purchasing a home in a few years… while enjoying what little spare time she has! It’s a lot to juggle, but a cash flow plan will help her map this all out, so she doesn’t overspend in any one area to the detriment of the others.

Middle Age

As one progresses into middle age, financial responsibilities may increase and get significantly more complicated. Cash flow planning will help you navigate these changes and make informed financial decisions.

You will likely need to plan for major expenses, such as post-secondary education for your children, home renovations, vehicle replacements, and of course retirement. By analyzing your cash flow, you can identify areas where you may need to reduce expenses, increase savings, or adjust your investment strategy. It can also help you pay less tax as you optimize your cash flow to minimize the size and frequency of taxable events.

Walter and Skyler are in their early 50’s, married with 2 teenage children. He has a good job and is trucking along according to plan in his career, but boy does the recent spike in inflation hurt. His cash flow seemed to be all good – covering the monthly bills, paying down his mortgage, contributing to his RRSP, putting money aside for his kids’ education – but his variable rate mortgage payments have jumped by almost $1,000 per month, and food, gas… well EVERYTHING is more expensive. Walter also is facing some possible health issues which could impact his ability to work. To avoid having to do something drastic, Walter and Skyler need to adapt their cash flow plan to work with the new environment they find themselves in.

Retirement

Retirement

In retirement, cash flow planning becomes even more critical. You will rely on your retirement savings – along with government and employer pensions, if applicable – to cover your expenses for the rest of your life, which means you need to manage your cash flow carefully.

By creating a solid inflation-adjusted retirement cash flow plan, you will ensure that your income sources are sufficient to cover your needs, not just on Day 1 or Year 1 of retirement but as your needs change over time. This will have implications for your investment strategy because the focus now is likely on generating a stable, reliable cash flow rather than on long-term growth of your portfolio – though with a hopefully long and healthy retirement, you’ll still need some growth too!

Din and Bo have had an exciting life together, with frequent travel to exotic places and adventures to last a lifetime. They worked hard and played hard, and money was never foremost on their minds – they knew they could always get another contract to earn more – but they are slowing down now and looking to retire. They are concerned that their savings may not last them through retirement which might force them to return to work later in life when they are less physically capable. They also have a sizable portion of their wealth in precious metals and need to turn their nest egg into a reliable income stream. Din and Bo recognize that developing a thoughtful cash flow plan that supports the kind of retirement they want is The Way.

As Money Coaches and advice-only financial planners, our specialty is helping our clients master their cash flow regardless of which stage of financial well-being they find themselves. From working with hundreds of clients, we know the challenges they can face due to an unstable or misallocated cash flow, or the anxiety they often feel when faced with turning a retirement portfolio into a tax-efficient income stream to last a lifetime. It’s cold comfort to have a healthy net worth on paper, but not have access to the cash flow you need when YOU need it.

Ultimately, everything in personal finance is related to cash flow, because without a reliable, consistent cash flow, life becomes stressful and uncertain. While large investment returns and “interesting” tax planning schemes get the limelight, remember that it all ultimately comes down to generating and maintaining the cash flow needed to support the life you have been working so hard to achieve.

Ultimately, everything in personal finance is related to cash flow, because without a reliable, consistent cash flow, life becomes stressful and uncertain. While large investment returns and “interesting” tax planning schemes get the limelight, remember that it all ultimately comes down to generating and maintaining the cash flow needed to support the life you have been working so hard to achieve.