By Steve Bridge, BA (Hons.), FPSC Level 1® Certificant in Financial Planning

With the Canada Revenue Agency (CRA) 2016 personal income tax deadline fast approaching, you are probably working overtime to get all of the forms and documents accounted for and organized.

Once everything has been organized, and you’ve filed your return to the CRA, you should spend some time thinking through what to keep, what to discard, and fully understanding your obligations related to record keeping.

Here are some important guidelines to remember:

• ‘Records’ are accounting and other financial documents that are kept in a (hopefully) organized way. This applies to both personal records like investment statements, utility bills, income tax credits, warranties; and also business records such as expense receipts, sales invoices, bank deposit slips, purchase invoices, payroll info, etc.

• If you are carrying on a business or engaged in a commercial activity in Canada, you are required by law to keep adequate records.

• Your records have to provide enough details to determine your tax obligations and entitlements.

• Your records have to be supported by original documents, whether paper or electronic. If electronic, the records must be supported and maintained by a system capable of producing records that are accessible to the CRA, encrypted or not.

• Your books and records must be physically kept at your place of business or your residence in Canada unless CRA grants permission to keep them elsewhere.

• Your books and records, both paper and electronic, must be made available to CRA representatives upon request. Have the receipts and documentation to support your claims ready in case you are selected for review.

• If you have more than one business, you must keep separate records for each business.

• Generally, you should keep your supporting documents for six years. This six-year period starts at the end of the tax year to which the records relate. The tax year is the fiscal period for corporations and the calendar year for all other taxpayers. However, note that if you file your tax return late, it is six years from the date you file! Hence, keeping things for seven years is usually a safer bet.

• If your business purchases an asset, records around this need to be kept for six years after it has been sold or the business ceases. Therefore, you are wiser to keep these invoices in a file separate from the year’s business expenses, just in case they get tossed six years later and you still have the asset!

• For personal documents such as utility bills, often people will keep one year’s worth to compare and contrast rates seasonally, or to have available should a potential home buyer request the information.

• Talk to your advisor concerning investment statements. You will need to hold on to the proper documentation when calculating any capital gains or losses.

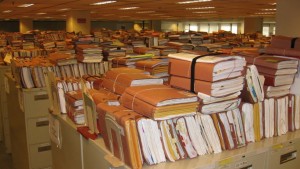

Bottom line is that we are required by law to maintain adequate records. Don’t let your file cabinet overflow and it don’t let it become overwhelming – make it part of your year end or annual income tax routine. Package up each year in a file, box or envelope, label it, store it safely, keep seven years’ worth and toss the rest!

Serving clients in North Vancouver, Steve Bridge is part of the Money Coaches Canada national network of Money Coaches. A Money Coach is a financial professional that helps clients develop a clear understanding of their current financial situation and create a plan that helps them reach their goals. Money Coaches Canada is the nation’s leading, independent provider of advice-only financial planning. Money Coaches do not sell investment or financial products.

My mother passed away in 2008. As an executor, how long should I save all the financial and other personal paperwork related to her passing, income tax and finances?

Thank you.

Joanne

Hi Joanne,

In your case, if you filed your mother’s final tax return in 2009, you should now be fine to get rid of her income tax documents. You may want to scan and save a copy to your computer so you will have them electronically (they wouldn’t take up much storage space on the computer).

Keeping the death certificate on hand would not be a bad idea, just in case.

I hope this helps.

I am the newly elected secretary for Elmwood Court in Wetaskiwin, AB. Along with the job came two huge binders full of documents from as far back as 1992 when this condo first opened it doors! I have 26 years of old Minutes and ByLaws, etc. on my desk right now and would like permission to shred much of it.

Some documents I would like to save for our history book.

I am asking permission to shred these very old documents to make room for future ones.

Do I need a form from your department to do this?

Thank you for your consideration of this.

Hi Elaine,

I’m afraid we are not the ones to ask about this and cannot grant you any permissions – I would suggest you contact your condo management/administration directly.

I have six years of household receipts – Visa, Enbridge, Hydro, etc – and six years of tax returns including CRA forms, charitable receipts, house insurance receipts along with WealthSimple tax returns and CRA notices of assessment etc. My wife and I are both retired. Is it necessary for us to keep the household files?

Hello Don,

Thanks for your question.

You should keep any tax-related files, that is documents supporting a claim made in a tax return, for six years. This is especially true if you did not provide a copy of the document to CRA previously, for example if you filed your tax return electronically or were not required to attached the records when filing a paper return.

You can discard documents older than six years. Some people scan older documents into digital form and store them electronically if they are concerned about discarding the documents completely.