In the early-1990’s, Karin Mizgala was on the fast track to success in the finance industry on Bay Street. Meanwhile, in a nearby tower, Sheila Walkington was launching her own promising career in financial services. While it would be years before they would meet, they shared the same conviction that something wasn’t right in the financial industry.

In the early-1990’s, Karin Mizgala was on the fast track to success in the finance industry on Bay Street. Meanwhile, in a nearby tower, Sheila Walkington was launching her own promising career in financial services. While it would be years before they would meet, they shared the same conviction that something wasn’t right in the financial industry.

Sheila literally grew up counting her pennies. She would give one of the five pennies she received as an allowance to charity and learned from her father how to use the other four to achieve her goals.

Fascinated with human behaviour, Karin chose to pursue degrees in business and psychology, which sparked an interest in financial education and coaching.

The Quest for a Better Way

When Karin and Sheila launched their careers as financial professionals, both wanted to use their training and experience to help people use their money to live better lives.

But they had serious misgivings about the way the financial system worked.

For them, the big problem was that financial advice was tied to the sale of products, like mutual funds and insurance. Both Karin and Sheila saw this as a massive conflict of interest – one that inhibits financial advisors from working in their clients’ best interests.

Unable to find a way around the system – and weary of Bay Street’s cutthroat work ethic – they did the unthinkable. They both headed west to Vancouver in search of an ethical alternative.

Still strangers at the time, each hoped to find an independent firm where they could build a financial planning practice where compensation was not based on commissions or referral fees.

But that ideal didn’t exist – so they found the next best thing.

Their career quests led them to the same reputable, boutique financial planning company deeply committed to comprehensive financial planning – the only drawback was that their compensation was still primarily tied to product sales.

However, a few years later the company was sold and the ‘bigger is better’ Bay Street mentality was back in full force.

The Aha Moment

That’s when they realized the only way to serve their clients and be true to their values would be to set up their own independent advice-only money coaching practices.

That’s when they realized the only way to serve their clients and be true to their values would be to set up their own independent advice-only money coaching practices.

At the time, neither of them knew that this seemingly small decision would change the way the financial services industry operates for good.

Independently, they each launched money coaching practices that were seen as revolutionary, because they focused on helping people, not selling products.

Both offered unbiased advice, charging transparent service fees instead of earning sales commissions or referral fees. Through this client work, they quickly discovered an unmet need for financial education that wasn’t simply a marketing tool to sell financial products.

In particular, they saw that women faced multiple challenges in overcoming barriers to financial success and were passionate about helping them develop more financial confidence, clarity and peace of mind.

So, in 2005, they combined forces and launched a series of workshops, for women, by women. The response was overwhelming, prompting them to create the Women’s Financial Learning Centre which offered workshops, online and self-study programs to make learning accessible to everyone who needed it.

After just a few years of operation, their respective money coaching businesses were booming.

It turned out that their clients really loved the idea of a money coach who worked for them instead of a financial institution.

So did the media.

As word of their innovative approach spread, the press picked up their unique story. This media coverage was a sign of the times that the demand for systemic change in the financial industry was growing.

People – clients and other financial services professionals alike – were frustrated by shrinking transparency and soaring fees and wanted alternatives.

Over a decade after starting their search for a more ethical way to help clients, Sheila and Karin realized that they had finally figured out how to shift the system with their advice-only, money coaching model.

With a desire to make real and lasting change to the system, they recognized they couldn’t do it alone.

Money Coaches Canada – Stronger Together

In 2010, they decided to run a grand experiment.

They bootstrapped a week-long program to train five new money coaches from across Canada at Karin’s home on Salt Spring Island in British Columbia. Developing the curriculum, hosting the coaches, cooking the meals and delivering the training all on their own turned out to be a crazy and exhilarating experience. As they wrapped up the week, they realized that the coaches would require more than just training to succeed.

They’d need a creative, collaborative business structure that would foster growth and innovation.

So, they founded Money Coaches Canada, a national company that gave clients and a team of like-minded financial professionals across the country access to coaching, advice and education – all under one roof.

So, they founded Money Coaches Canada, a national company that gave clients and a team of like-minded financial professionals across the country access to coaching, advice and education – all under one roof.

Since then, Money Coaches Canada has continued to grow, developing new programs, services and expertise that embody Sheila and Karin’s values and passion.

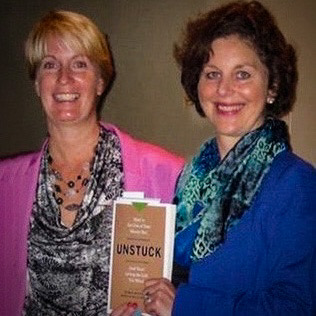

They published two books, UNSTUCK and YOUR MONEY MAP, launched the 7 Stages of Financial Well-Being® coaching system and published hundreds of blog articles and resources.

Advocating for a Better World

Ten years after founding the company, Money Coaches Canada is the largest advice-only financial planning firm helping thousands of clients take the worry out of money and create their ideal life.

Widely quoted in dozens of publications, Karin, Sheila and their team continue to champion – through media, industry associations and regulators – for a more transparent, ethics-based, client-first financial planning profession. Their goal remains the same as it was in the beginning – to better serve the financial interests of all Canadians.