By Jenny Reimer, CIM, CFP®

COO and Director, Financial Planning

One of my favourite parts of my work is helping our clients define their goals. Some goals are common, like buying a home or saving for a child’s education, and others can be more surprising, like taking a year-long sabbatical, starting a new business, or retiring to a different country. Digging into these goals, finding out where they came from and why they’re important, is a daily source of inspiration for me.

At Money Coaches Canada, while our main focus is financial planning, our clients’ goals are never entirely financial. Feeling in control of our money, knowing that our family will be taken care of after we’re gone, and enjoying life along the way are high priorities for all of us.

How do we balance these short-term, long-term, more basic, and more extraordinary goals? How do we make sure we’re not so caught up in the day-to-day that we forget about what inspires us and brings our life meaning? How do we move from survive to thrive?

Aligning your money with your values is a critical part of our work. When you review your bank account or credit card statements at the end of the month, do you see your hard-earned money being spent on the things you value? For many of us, the answer is… less often than we hoped.

From time to time, we all get stuck in the trap of thinking this new purchase will make us happier, impress our friends, or show our family how much we love them. If you’re like many of us, you might absentmindedly be spending money on things you don’t even need, like extra streaming services, food that goes to waste, or new clothes that are never worn. The path of least resistance is often lined with food delivery charges and plastic toys that were our children’s prized possession for less than five minutes.

Being mindful of our spending and clarifying our cash flow is a powerful way to improve our financial well-being. Not only does it leave more money for goals that are important to us, but we feel more at peace when we’re using our resources in ways that move us closer to the life we want. No one plans to waste their money. Sometimes, we just need motivation or a new perspective to realign our money with our values.

When we help our clients be more mindful of their spending, we often suggest they add any money leftover at the end of the month to their travel savings account. There’s something about the idea of going somewhere new or taking a break from our regular lives that can be very motivating. It seems easier to say no to an unnecessary purchase when you’re really saying yes to an upcoming adventure.

My family and I recently returned from a trip overseas. We had been planning, anticipating, and saving for this holiday for more than a year. We spent hours discussing where we wanted to go, what we wanted to do, why it was important, and what we were willing to give up in order to make this trip happen.

Our time away wasn’t perfect, but it was extraordinary. We spent time together in a more fulfilling way than we can at home, where the distractions never seem to end. My husband and I watched our daughter’s understanding of the world grow right before our eyes. And, as with most adventures, the small, unexpected moments are the ones we will remember most.

Perhaps travel is such a powerful motivator because we know, mostly subconsciously, that disconnecting from our regular lives allows us to reconnect with the people who matter most. Travel reminds us that lasting joy doesn’t come from objects, it comes from experiences. Our minds are living scrapbooks, collecting memories, framing them, and looking back on them, often not fully appreciating their beauty and importance until later.

My home is now full of photos from our recent trip. I walk by them in the hall while I’m carrying laundry or catch a glimpse of one while I’m making dinner and I smile to myself. The details will fade, but the feeling of adventure and connection will stay with me. Which is why I wasn’t surprised when, as we were unpacking our suitcases and emptying our travel wallets, my daughter asked if she could save her leftover Euros for our next trip. She, too, understood the value of what we had gained by stepping away from our regular lives. And she was willing to save up to do it again.

Sometimes a holiday or a life defining moment can bring about change. Other times, we just find ourselves in a place where we’re ready to take control of our finances and move more intentionally towards our goals.

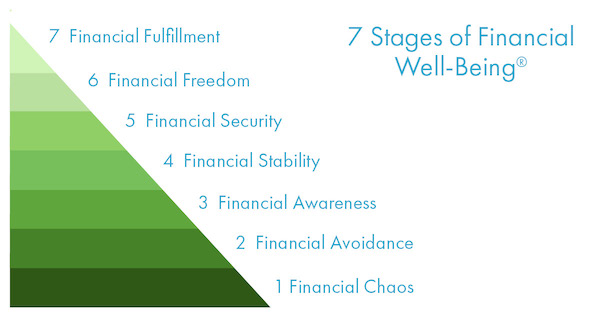

We created the 7 Stages of Financial Well-Being®, a framework Canadians can use to identify their feelings and behaviors towards money, assess their current situation, and focus on the right things to improve their financial well-being.

Knowing where you stand on an objective framework like the 7 Stages allows you to take stock and re-focus on the best next steps to meet your goals, regardless of your income.

We invite you to take the 7 Stages of Financial Well-Being quiz. The quiz will provide you with an understanding of where you are today and offer concrete action steps to improve your financial future.

Hustle and accumulation can feel satisfying in the moment, but I often find that feeling doesn’t last. Instead of collecting more weeknight commitments and online shopping, I’m trying to collect more moments. And I will continue to work, with patience and intention, towards my own version of Financial Fulfillment.

If you would like to learn more about our 7 Stages of Financial Well-Being® and how we help our clients align their money with their values, please contact us for a free consultation.

I’m in stage 7, living and volunteering through Cuso, in Shinyanga, Tanzania. I’m just back from a 16 day safari in Kenya and Tanzania, which was very economical as I was already in East Africa. My photos are on my phone but I continue to meet the locals, shop locally and taste the fresh fruits and veggies. Glad I figured out my priorities a few decades ago.

Sherry, thanks for sharing your amazing experience, and congratulations on reaching Stage 7 (Financial Fulfillment) and living your best life!