Do you Have the Right Investments for a Comfortable and Secure Retirement?

An Investment Coaching Program for Women retiring in less than 10 years

If you’re like most women approaching retirement you understand the importance of making smart decisions with your money, but you aren’t sure if your investments are being managed as well as they should be.

If you’re like most women approaching retirement you understand the importance of making smart decisions with your money, but you aren’t sure if your investments are being managed as well as they should be.

Even if you are working with an investment advisor, you may be struggling with how to do a proper assessment of your portfolio and whether your retirement goals are achievable. Confusing financial jargon and advisors that don’t take the time to learn about you, your concerns and real-world needs only adds to your frustration.

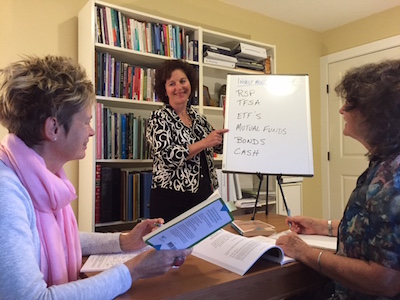

Please join Karin Mizgala, co-founder of the Women’s Financial Learning Centre and Money Coaches Canada for a day dedicated to you and your investment success.

This program is particularly suited to women who are less than 10 years away from retirement.

Together, we will answer many of your questions on money, investing and securing your financial future, including:

- How are my investments really performing?

- Are my investments well-suited to who I am, my unique circumstances, and where I want to be in the future?

- How can I protect what I have while still building wealth?

- Will I have enough to retire?

- How can I assess whether my advisor’s recommendations are truly in my best interest?

- Is real estate a better investment than the stock market?

- RSP, TFSA, ETF, Mutual funds – how do I decide what’s best for me?

- How much am I really paying in fees? ? (You are probably paying thousands of dollars more than you need to!)

During this day designed to grow your confidence, Karin will share with you an innovative framework that helps all types of investors, regardless of investing knowledge or experience, answer some fundamental questions regarding their investments. You will:

During this day designed to grow your confidence, Karin will share with you an innovative framework that helps all types of investors, regardless of investing knowledge or experience, answer some fundamental questions regarding their investments. You will:

- Learn how to review and better understand your investments;

- Become familiar with the different types of organizations and resources available to you to implement your investment strategy;

- Hear about the investment companies and strategies to avoid;

- Learn which questions to ask your investment advisor in order to monitor your investment portfolio with confidence;

- Know how best to terminate a relationship with an advisor that’s not working; and

- Receive unbiased, easy to understand guidance every step of the way.

Successful investing begins with you – an understanding of who you are, what you value and your relationship with money. Where you are today, and where you want to be tomorrow. It doesn’t have to be overwhelming or confusing.

Successful investing begins with you – an understanding of who you are, what you value and your relationship with money. Where you are today, and where you want to be tomorrow. It doesn’t have to be overwhelming or confusing.

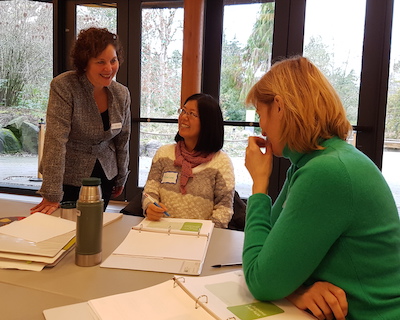

Successful investing requires knowledge, confidence, and a plan with the right support. A plan that you understand and believe in; one that you are committed to and will help you avoid making emotional, often costly, investment decisions. During this one day workshop – we cover it all in an enjoyable and engaging environment.

A visionary within financial services, Karin has pioneered a revolutionary approach to financial planning. She has helped thousands of clients save more, invest better, and take control of the financial future. She understands the challenges women face, and her unique perspective and approach will put you on the path to investing success.

Karin will lead just 8 participants through group and one-on-one discussions, exercises, presentations and round-table sessions in an enriching, collaborative environment with women that share similar concerns. You will learn about:

- The principles of investment portfolio construction and rebalancing;

- The benefits of diversification;

- How investments are taxed and strategies for tax minimization;

- The latest investment products and solutions available to investors;

- Socially responsible investing;

- The importance of evaluating investment returns against appropriate benchmarks;

- How to avoid common investment mistakes and unnecessarily high fees;

- The impact economic and socio-economic trends can have on investment returns;

- Commonly used terms and phrases related to investing and financial planning; and

- Important changes affecting the wealth management industry, including the disclosure of information from advisor to client (CRM2).

The world of money and investing has never been more complicated. And the stakes couldn’t be higher with retirement right around the corner. It’s essential that you have someone that can provide an independent, objective perspective that you can trust.

Please register your interest by completing the form below. We will let you know when the next session is scheduled.