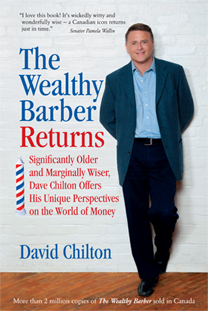

The author of the popular book “The Wealthy Barber” has done it again with his new book “The Wealthy Barber Returns”. He wrote this book out of frustration watching Canadians savings rates diminish and debt levels soar out of control. This new book shows humor on a topic that most of us don’t want to talk about, but who need the information now more than ever.

The author of the popular book “The Wealthy Barber” has done it again with his new book “The Wealthy Barber Returns”. He wrote this book out of frustration watching Canadians savings rates diminish and debt levels soar out of control. This new book shows humor on a topic that most of us don’t want to talk about, but who need the information now more than ever.

Although Chilton has dropped the characters from the original story, it’s still laced with wit and humor and makes for an easy read on an otherwise dry topic. The world has changed since the original barber named Roy was giving advice. We were just getting into the world of online trading using program trading tactics, the markets were generally up, with some significant crashes around the time this original book was published. At that time the late baby boomers were starting to sit up and ask questions about their finances.

The new book is an update reflecting today’s world. Now interest rates are much lower, credit is abundant and technology has made people want more and more. Online trading has evolved so much that you can be a “do it yourself” investor. Chilton’s advice is needed more than ever.

The new book builds on the original sound financial advice, poking fun at some of his previous advice in an ever changing environment. He ends his book with a “Potpourri” of his personal recommendations and a simple financial plan.

Who should read this book?

Anyone that feels they are alone with high interest credit card balances and those lines of credit that seem to be on the “never never” plan. There is a definite way to get out of debt and he provides some hope.

This book is also a fun read for those in the financial industry, and speaks to those with a little knowledge about finances but wanting a “jump off” point to start learning more.

Key Points & Take-aways

- Four Liberating words – “I can’t afford it” and sound advice like “People who tend to live within their means are happier people”

- The effects of taking on too much credit

- House arrest, taking on too big of a mortgage

- The chapter on saving later in life and why this is so important if you didn’t start younger.

- He explains simply how the stock market pricing works and how the financial index works.

- There is good information that explains TFSA, RRSP’s and RESP’s in easy terms.

- Doing the math when it comes to the $64,000 question, “Do I have enough to retire?”

Reviewed by: Leslie Gardner, Money Coach

Reviewed by: Leslie Gardner, Money Coach

I attended David Chilton’s talk held at Holiday Inn in Vancouver. Great speaker and very funny. We all recieved a free copy of his book and he autographed it. I did manage a quick chat with him, very nice man.