Director, Communications

When someone asks me what I do and I tell them I’m a financial planner, it’s not uncommon to see their guard immediately go up just a little bit. They often assume there’s a sales pitch coming.

This perception of financial “advisors” as salespeople isn’t without some basis in reality. In Canada, the vast majority of financial advice is tied to product sales of one kind or another. This can introduce a conflict of interest and make one wonder: is this advice best for me, or is it best for the advisor?

Unfortunately, in some cases the public’s wariness of commission-based financial advisors is well-deserved. While such interactions are certainly not universal, they are more common than they should be.

In contrast to the sales-oriented model used by the majority of the industry, there is another growing model of financial advice delivery in Canada.

Whether it’s called fee-only, fee-for-service, or the term we prefer, advice-only, it is a simple arrangement by which professional, customized advice is offered for an agreed upon scope of work at a stated fee. As the name indicates, there are no product sales involved: it is strictly advice-only.

There are many advantages to delivering financial advice in this way:

- The advice is unbiased and objective, avoiding the conflicts of interest often encountered when sales commissions or referral fees are involved.

- Since you know you aren’t going to be sold any products that benefit the advisor, there is a higher level of trust and transparency, allowing for more open and honest conversations about your goals, concerns, and the best strategies to address them.

- Strategies proposed are customized to your particular circumstances without the pressure on the advisor of having to incorporate some kind of product sale to generate a commission.

- Financial education is often a significant part of the planning engagement, empowering you to make better financial decisions in many aspects of your everyday life.

- Comprehensive financial planning takes into account your short, medium and long-term goals, with ongoing and evolving advice and support as circumstances change.

- Since advice-only planners are paid for agreed upon advice and services rather than product sales, they can co-ordinate with other financial professionals on your team, including your accountant, investment manager, insurance provider, lawyer, etc. to ensure you are covered on all sides.

- With a transparent fee that is disclosed upfront, you know exactly what you are paying for the service.

Wait, what? “I’m paying for this service? Why would I pay for financial advice? My current advisor doesn’t charge me anything for their service!”

Ahem. I’ve got some news for you.

For some prospective clients, when compared to the “free advice” out there, the fee associated with advice-only financial planning can come as a surprise. The fee varies depending on the scope of the service provided and the complexity of the client’s situation but will often run from a couple thousand dollars to ten thousand or more for complex situations.

Why does advice-only financial planning cost what it does? Here are some contributing factors:

1. Expertise and Qualifications

Unlike some of the “advisors” in the CBC MarketPlace video linked above, advice-only financial planners are highly qualified professionals with extensive training and experience. They often hold certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) which are obtained after years of education, exams and practical experience, and must be maintained annually through continuing education.

2. Comprehensive Analysis

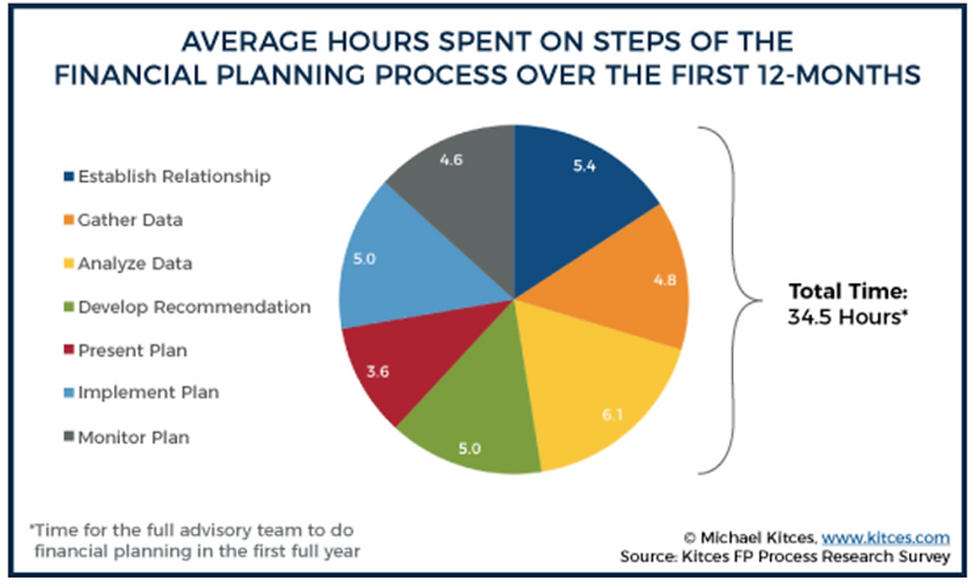

A core component of comprehensive advice-only planning is the thorough analysis of your financial situation. This involves evaluating your income and expenses, investments, tax situation, insurance, and estate plans. Planners use sophisticated tools and methodologies to model different scenarios and outcomes. This level of detail requires significant time and effort.

3. Objective Advice

As previously noted, unlike traditional financial advisors who might earn commissions or fees based on the financial products they recommend, advice-only planners are compensated solely for their guidance. You are the only one paying your planner. This model ensures that the advice you receive is unbiased and solely in your best interest.

4. Personalized Strategy Development

Creating a customized financial plan is not a one-size-fits-all process. Each client’s needs, goals, and circumstances are unique. Developing a tailored strategy that aligns with your financial goals requires a deep understanding of your personal situation and future aspirations. This approach involves careful planning and strategic thinking. The more complex your situation, the greater the time needed to create your plan and the higher the fees will be.

5. Ongoing Support and Adjustments

Good financial planning is not a one-time event but an ongoing process. Advice-only planners can provide continuous support and updates to ensure your plan remains aligned with any changes in your life or the general economic environment. This ongoing service, including regular reviews and adjustments, can be customized to your needs and will be reflected in the fees you pay.

6. High-Quality Tools and Resources

Planners use advanced financial planning tools and software, which can be expensive but are crucial for delivering accurate and effective financial strategies. As with any business, the cost of maintaining and updating these tools is factored into the fees charged to clients.

7. Ethical Standards and Accountability

Advice-only planners adhere to high ethical standards, focusing on the best interests of their clients without any conflicts of interest. Maintaining these standards requires a commitment to professional integrity and accountability. Professional planners with the Certified Financial Planner® (CFP®) or Qualified Associate Financial Planner™ (QAFP®) credential must be a member of FP Canada and follow the Standards of Professional Responsibility, and are often members of other professional associations. Professional planners should also have appropriate liability insurance.

Investing in Advice-Only Financial Planning Could be the Best Investment You’ll Ever Make

The cost of advice-only financial planning reflects the expertise, time, and resources required to deliver unbiased and comprehensive financial guidance. While at first glance the price may seem high, it’s important to consider the value of having a personalized, objective strategy that aims to optimize your financial well-being. In the long run, the insights and guidance you receive can lead to significant financial benefits, making the investment in advice-only planning possibly the best investment you’ll ever make.

It’s a bold claim, but one we firmly believe.

If you’re contemplating whether advice-only financial planning is right for you, consider the value of achieving your financial goals with a trusted, impartial partner by your side. Reach out to us for a no-obligation, complimentary consultation to see if we’re a good fit to work together.