By Daniel Evans, BSc., CLU®, CFP®

You work hard and understand how important an investment portfolio is to your financial well-being. However, simply owning an investment portfolio isn’t enough.

You work hard and understand how important an investment portfolio is to your financial well-being. However, simply owning an investment portfolio isn’t enough.

The unfortunate truth is that most Canadians receive financial advice from commissioned salespeople that are paid to sell specific financial products and services. But you need investments that work for you, and only you.

Despite all the jargon and the financial industry’s best efforts to keep investors in the dark, it’s not hard to develop the basic knowledge to evaluate your investments on your own. At the very least, educating yourself on some of these basic concepts, and getting comfortable with the language, will put you in a much better position to have an informed discussion with your advisor.

It’s vital that you develop a basic understanding of how to evaluate your investment portfolio that’s independent, free of bias, and has only your best interests in mind. Learn the following concepts and implement these best practices, and you will be on your way to investing like a professional.

Master the Basics

There are a few fundamentals that every investor should master. Regardless of age or circumstances, these principles should be your guide to long term investing success

Starting sooner is better than later: Compound interest (earning interest on your interest), is the “magic formula” of investing, so the sooner you invest, the more time you have to benefit from this multiplying effect.

Keep some funds easily accessible: Having an emergency fund in a savings account, guaranteed investment certificate (GIC) or money market fund can give you peace of mind at all stages of your life.

Strike a balance: Be sure your investments strike a balance between the best return on investment and your comfort level. Having some of your savings in stocks can help offset the diminishing effect of inflation on more traditional savings. But it’s important that you can afford that risk financially and emotionally.

Schedule an annual review with a financial professional: Adopting this one habit can have a huge impact on your financial future. Keeping your investment strategy at pace with your life is essential to long term success.

Understand how your investments impact your taxes: Some investments are taxable, while others are tax-deferred or tax-free. It’s important that you consider the tax implications at the time of investment, and when it’s time to make a withdrawal.

Take A Structured Approach

Like most things in life, when you approach a difficult problem with a well-defined structure to break it down and analyze it, you are much more likely to be successful. At Money Coaches Canada, we believe the best way to evaluate an investment portfolio is to break it down into five areas and examine each one independently. Ask yourself the following about your investments:

- Fees: Find out how much you are really paying in fees, and understand your options to reduce investment costs

- Performance: Get a clear picture of how your investments are performing, and uncover options to enhance returns

- Alignment: Ensure your investments are aligned with your values, goals and investor profile

- Asset Allocation: Receive detailed recommendations on how to allocate your money amongst various asset classes, likes stocks and bonds

- Asset Location: Receive expert advice on the most tax-efficient ways to hold your investments – from options like RRSP, TFSA and non-registered accounts

Review Your Investment Statements Carefully

Every Canadian investor receives two account-based reports, delivered together, covering the same 12-month period. Every year, you should be receiving: Report on Charges and Other Compensation; and Report on Investment Performance.

The Report on Charges and Other Compensation lists the fees and charges incurred in your account. It includes everything from administration fees, transfer or account closing fees, short term trading fees, transaction or sales charges and redemption fees.

However, investors are still not getting the full picture of fees. Despite the many steps forward, the Report on Charges and Other Compensation does not include the Management Expense Ratio (MER), which means Canadians with investments in mutual funds still won’t have a complete snapshot of what those investments cost.

The Report on Investment Performance, on the other hand, details how well your investments are doing. Performance should be disclosed using three standard measures: opening market value, change in market value and personal rate of return.

We strongly recommend that you pay special attention to your personal rate of return. Each advisor is required to perform this calculation in the same way, which will make this information consistent from one advisor or dealer to the next.

Please get comfortable reviewing these reports and make it a habit to review them carefully and get answers to any question you have. Many Canadians will be surprised by what they read on these reports and will have serious questions for their advisors. Here are three things you need to do after reviewing these reports for the first time:

Don’t Fear Fees, Understand Them

It doesn’t matter if you are new to investing or have a large portfolio, it’s important to take the time to understand fees.

First off, there is no way around paying fees. Even if you decide to manage your own investments, you will still end up paying fees, albeit typically lower than for a managed portfolio.

If you are working with a financial advisor, ask questions and don’t tolerate an advisor who tries to baffle you with jargon. It’s also important to understand how a financial advisor is paid. It may seem like a deal to use an advisor who is paid by an investment company, but be sure that ‘free’ advice is actually free of bias.

It’s important that you understand it’s not uncommon for a financial advisor to receive a higher commission for recommending a specific type of investment. Speak with your advisor to gain a better understanding of how they are being compensated for specific investing recommendations. You need to be confident that your interests are all that’s being considered when investment advice is provided.

When it comes to fees, it’s vital you understand their impact on your portfolio’s performance over the long term. Consider the following example.

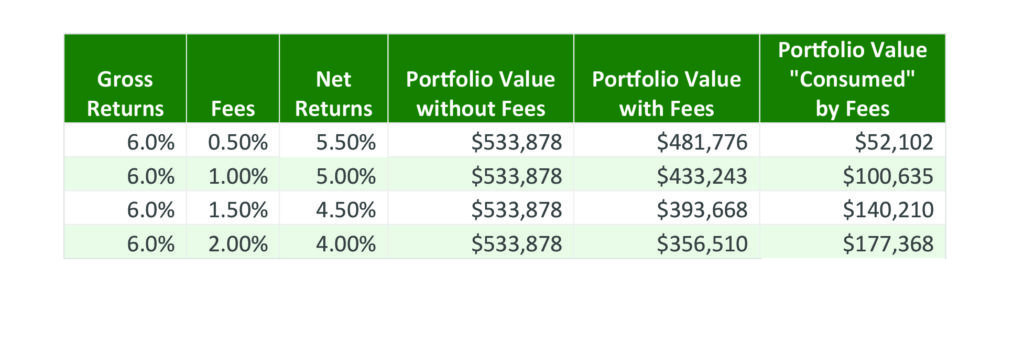

Imagine you contribute to your investments over a 30-year career. You start with an initial investment of $25,000. You invest an additional $5,000 per year until year 30. Let’s assume a 6% annualized gross return. Sounds good, but your net return over the 30 years will be reduced by the fees that you paid. It could be significant. In the chart below, the only variable is the fees. I think you’ll agree that the impact is worth paying attention to. Shouldn’t you ensure you aren’t paying more than necessary?

Be Sure Your Investments Reflect Where You Are in Life

Life is busy, but most of us make time for tasks, big and small, that we consider essential: an annual medical check-up, oil changes for the car, fresh batteries in our smoke detectors, and getting our taxes done by April 30 are just a few examples.

But surprisingly, an annual investment check-in, one that considers your approach to investing, isn’t always on that priority list.

The pace of modern life makes it feel like the years pass very quickly, but they are still 12 months long, and a lot can change. For example, one or several of these things could happen to you over the course of a year, and each one could have a significant impact on your finances: marriage, divorce, birth of a child, new job or promotion, loss of a job, health issues (for yourself or a loved one), new home, child goes to university, or the unexpected (major home repairs, an extended family member that needs assistance, or any other out-of-the-blue circumstance that affect your finances).

Has any of those events happened to you? Each is significant, taking up all our energy and focus for a period of time. But when the dust settles, it’s important to consider the impact of the change or event on our finances. An annual check-in provides the opportunity to adjust.

Chose Investments That Reflect You

Have you given any thought about the impact your money, and investing, has on the world? We don’t need to be wealthy investors to act more intentionally with our money. What are you passionate about? What world would you like to see? What are you happy to own? Are the investments you have in alignment with what you value and believe in?

Business leaders and entrepreneurs at all levels—can make sure that they are thinking about the long-term impact of their businesses. Ambition can, and must, be a force of collective good.

We decide where we spend our dollars. We can support businesses that care about the impact their products have on people and our planet. We also decide who we will be, how we will act, and what we will value.

If you are interested in learning more about socially-conscious investing, a great book to read is The Clean Money Revolution by Joel Solomon.

Ready to Invest Like A Professional?

If you’ve made it this far and understand the finer points of this blog post, you are further ahead than most Canadian investors. Be confident, ask lots of questions, and never stop learning about how to become a more informed investor.

If you still have concerns with your investments and would like an independent, unbiased review of your portfolio, book a chat with an Investment Coach or check out the Investment Report Card™.

I take your point that fees can eat up a (sometimes sizeable) chunk of your portfolio. But for me, I find the value of a full-service advisor/broker to be worth the money (and I’m generally a cheapskate). My financial advisor has “saved me from myself” more than once. He gives me a fuller picture both of an individual investment and the whole wide sweep of the market, so helps me avoid making bad decisions that I would have made otherwise out of fear, or incomplete information. I prefer seeing him quarterly, not once a year. I’d suggest that while the math in your table is compelling, the reality, for me at least, is that my portfolio would not have been the same without his advice, and would not have done as well without it.

Good point Kristin. It’s definitely a question of value for fees. If you are getting great service, good returns, financial planning and an accountability partner, a full service advisor can work well.